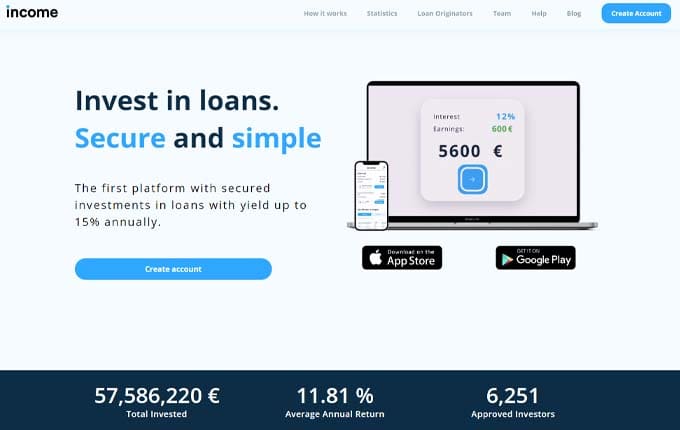

Income Marketplace

Invest in loans. Secure and simple.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

12.00 %Min. investment

10 €Income Marketplace overview.

If you are considering investing through the Income Marketplace platform, we have created this review to help you assess whether it is the right choice for you. Our review explores the investment options offered by Income Marketplace and evaluates the platform's safety measures. Our objective is to provide you with valuable insights that will aid in your decision-making process regarding Income Marketplace as an investment platform.

What is Income Marketplace?

Income Marketplace, an Estonian peer-to-peer lending platform, provides an online community for investing in loan originator debt with a minimum investment of €10. The platform primarily caters to retail investors and offers investments denominated in EUR. Income Company OÜ, founded in 2020 and based in Tallinn, Estonia, is the company responsible for operating the platform.

The core objective of Income Marketplace is to enhance the safety and transparency of investing in loans. To achieve this, the company employs a structure where loan originators hold junior shares, while investors on the platform hold senior shares. Additionally, Income Marketplace maintains a cash flow buffer to safeguard investors in the event of defaults, which will be further discussed in the review.

How does the Income Marketplace work?

Income Marketplace operates on a two-sided business model. On one side, they cater to investors, while on the other side, they collaborate with a variety of loan originators who require funding for their borrowers.

The process begins when a consumer applies for a loan through one of the partner lenders. The borrower's financial situation and creditworthiness are thoroughly assessed before approving the loan. Once the borrower is deemed suitable, the loan is disbursed.

To expand their lending capacity, the loan originators seek additional liquidity by transferring the loans to other investors. This is achieved by listing the loans on the Income Marketplace platform, where investors have the opportunity to invest in these loans at a lower interest rate than what the loan originator originally lent the money for.

Investing with Income Marketplace

Getting started with Income Marketplace and initiating the process of generating interest on the platform is remarkably straightforward. Here are the steps to begin your journey:

- Open an account and undergo the verification process, which typically takes less than 2 minutes. You'll be provided with a QR code that enables you to quickly capture a selfie and a photo of your ID card for identity verification.

- Deposit funds into your account to commence investing in loans and earning interest. Income Marketplace simplifies the deposit process by allowing you to make a bank transfer. Simply transfer the funds to the designated LHV bank account of Income. It's essential to include your reference number during the transfer to ensure proper allocation to your investor account. The reference number can be found within your Income Marketplace account. Typically, the transfer should be completed within two business days.

- Please note that Income Marketplace only offers investment opportunities to individuals residing within the European Union (EU) or the European Economic Area (EEA). Investors from outside these regions are not currently eligible to participate in the platform.

By following these steps, residents of the EU or EEA can easily commence their investment journey on the Income P2P Marketplace and start generating returns.

Investor protection mechanism

When engaging in P2P lending, it is crucial to assess the level of protection offered and the quality of the loans you intend to invest in. Specifically, it is essential to consider the buyback guarantee and evaluate the financial information of the loan originators along with the performance of their loan portfolio.

At Income Marketplace, all loans are accompanied by a 60-day buyback obligation. This means that if a borrower becomes more than 60 days overdue on payments, the loan originator is obligated to repurchase the loan from investors, reimbursing the full principal and interest. However, seasoned investors recognize that the effectiveness of the buyback guarantee relies on the financial stability of the loan originators and the performance of their loan portfolio.

By carefully examining the financials of the lenders and analyzing the historical performance of their loans, investors can make informed decisions regarding the level of trust and reliability associated with the buyback guarantee provided by Income Marketplace. This evaluation process helps ensure that investors have a comprehensive understanding of the potential risks and rewards before investing in loans on the platform.

Junior Share & Cashflow Buffer

Income Marketplace positions itself as the "safest" marketplace in Europe by implementing additional protection mechanisms such as the "junior share" and "cash flow buffer."

Typically, in most P2P lending platforms, loan originators co-own loans on equal terms with P2P investors, ensuring shared risk. Income Marketplace has enhanced this safety measure by introducing a structure where loan originators hold a junior share of the loan, while P2P investors hold a senior share. This distinction is significant because senior shares have higher priority in debt recovery. In the event of a loan default, P2P investors are entitled to the full amount of the loan before the loan originator receives any funds.

Furthermore, Income Marketplace maintains a cash flow buffer to safeguard investors in case of a loan originator default. The cash flow buffer consists of the cumulative amount of junior shares and loan profitability, which serves as a protective reserve. In the event of a loan originator's default, the cash flow buffer is utilized to secure investors' interests. This means that the junior shares, along with interest and fees, are first utilized to repay the principal and interest owed to investors. Only after fulfilling these obligations are any remaining funds allocated to the loan originators, if feasible.

By implementing these additional protection measures, Income Marketplace aims to enhance investor confidence and provide an added layer of security in the event of loan defaults or loan originator disruptions.

Auto-investing on Income Marketplace

Income Marketplace offers a convenient auto-invest function that enhances user experience. The auto-invest feature comes with a wide range of customizable filter options, allowing investors to tailor their investment preferences according to their specific criteria. Investors have the flexibility to define parameters such as loan amounts, interest rates, loan terms, loan types, countries, lenders, statuses, and even loan extensions.

By utilizing these filters, investors can streamline their investment strategy and ensure that their funds are allocated to loans that meet their preferred criteria. This automation simplifies the investment process and saves time, as investors no longer need to manually select individual loans. The auto-invest function on Income Marketplace provides a user-friendly and efficient way to diversify investments and maximize opportunities within the platform.

Secondary market on Income Marketplace

Currently, the Income P2P marketplace does not provide a secondary market or a "one-click" exit button. As a result, the liquidity of your portfolio is dependent on the loan term you choose when investing. So, if you decide to invest in short-term loans, you can expect to withdraw most of your investments within a two-month timeframe. The relatively shorter loan term of these payday loans allows for quicker access to funds compared to loans with longer durations.

However, it's important to consider the specific loan terms and conditions before making investment decisions on the platform. The absence of a secondary market or immediate exit option means that investors should carefully assess their investment horizon and liquidity needs when choosing loans on the Income P2P marketplace.

Summary of Income Marketplace review

Income Marketplace is an emerging Peer-to-Peer lending platform that prioritizes investor safety in the P2P investing space. While it offers the commonly found buyback guarantee, it distinguishes itself from competitors through unique features such as loan originators holding only junior shares and the presence of a cash flow buffer for added security.

The platform maintains a high level of transparency, making it easy for investors to engage. The inclusion of an auto-invest feature streamlines the investment process and enhances user experience. However, it's worth noting that a drawback of Income Marketplace is the absence of a secondary market. This limitation restricts the liquidity of investment portfolios and may impact the ability to sell or transfer investments before the loan term concludes.

Overall, Income Marketplace is committed to providing a safer investment environment and offers convenience through its user-friendly platform. Investors should consider their liquidity needs and investment preferences when assessing the suitability of the platform for their individual goals.

Income Marketplace summary

Investing with Income Marketplace offers several advantages:

- Competitive returns: Income Marketplace provides investors with highly competitive returns, with an average annual return of 12% within the P2P lending market.

- Buyback guarantee: all loans listed on Income Marketplace come with a buyback guarantee, ensuring that if a borrower is unable to repay the loan, the loan originator will repurchase it from the investor.

- Junior Share & Cashflow Buffer: Income Marketplace prioritizes investor protection by implementing a unique structure where loan originators hold junior shares and a cash flow buffer is maintained to mitigate risks.

- Low minimum investment: with a minimum investment requirement of only 10 euros, Income Marketplace offers accessibility to a wide range of investors, including those with a limited budget.

Points to consider when investing with Income Marketplace:

- Lack of secondary market: Income Marketplace does not provide a secondary market, which means that once you invest in a loan, you cannot easily sell or exit your investment before the loan term ends. This may limit liquidity and your ability to access your invested funds.