Swaper

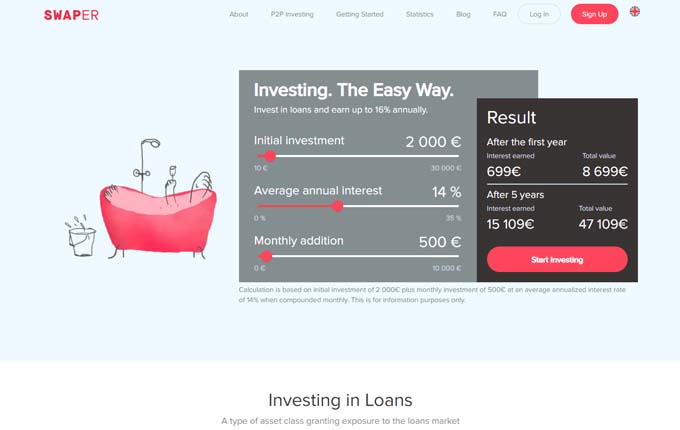

Investing. The Easy Way.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

14.00 %Min. investment

10 €Swaper platform overview.

If you are interested in investing through Swaper, we have prepared this review of Swaper.com to assist you in making an informed decision. It is important to note that the review represents our own opinion and findings, and it should not be regarded as financial advice. We aim to provide a comprehensive assessment of both the advantages and disadvantages of Swaper to help potential investors evaluate whether it is the right platform for them.

What is Swaper?

Swaper is a Peer-to-Peer (P2P) lending platform based in Estonia. It facilitates investments in pre-funded, unsecured short-term consumer loans originated by the Wandoo Finance Group, which is the parent company of Swaper. One of the advantages of Swaper is that it allows investors to get started with a minimum capital of just €10.

One notable feature of Swaper is that there are no fees associated with opening an investment account, adding funds, or withdrawing funds. These transactions are completely free of charge. Additionally, if you invest more than €5,000, you are eligible for a +2% loyalty bonus on all your investments.

It's important to note that Swaper operates in accordance with the legislative acts of the Republic of Estonia. However, it's worth mentioning that Swaper is not a regulated financial institution, and the claim rights available for purchase on its website are not considered securities or any other regulated financial instruments.

How does Swaper work?

Swaper exclusively collaborates with Wandoo Finance Group as its sole loan originator, operating under the name Wandoo in multiple countries. Unlike other platforms that work with multiple loan originators, Swaper focuses solely on Wandoo. Additionally, Swaper offers all loans at a fixed interest rate of 14%.

A distinguishing feature of Swaper is its VIP investor program. If you invest over €5,000, you qualify as a VIP investor and receive a +2% loyalty bonus, boosting your annual return to 16%.

Wandoo provides consumer loans with durations of up to 30 days, ranging from €50 to €1,500. These loans are acquired by Swaper through assignment agreements between Swaper and Wandoo. Once acquired, the loans are made available to investors on the Swaper platform. Investors can expect to earn a fixed interest rate of 14% per year, and this rate increases to 16% for VIP investors enrolled in the loyalty program.

Investing with Swaper

To register on Swaper, you need to meet the following requirements: be at least 18 years old and reside within the European Economic Area. Additionally, you must have a bank account in your name from the country of your residence. If you're interested, Swaper also offers the option to open a business account. The registration process involves completing a registration form and submitting electronic copies of your Passport or ID card. To validate your identity, you will also need to provide a recent utility bill as proof of address.

What rate of return can you expect?

The return you can expect on Swaper varies based on your investment amount. If you invest under €5,000, you can anticipate an annual return of approximately 14%. However, if you decide to invest €5,000 or more, you will be eligible for a loyalty bonus of 2%. With the loyalty bonus, your annual return will increase to around 16%.

Swaper buyback guarantee

Swaper offers a buyback guarantee for the loans listed on its platform. If a loan becomes overdue for more than 60 days, Swaper provides a buyback on the claim rights associated with that loan. The buyback guarantee ensures that you will be reimbursed for both the principal amount you invested and the interest you would have earned from the borrower.

However, it's important to understand that the effectiveness of buyback guarantees depends on the financial stability of the platform or loan originator providing them. In the event that Swaper or Wandoo Finance Group were to cease operations, there might not be a mechanism in place to honor the buyback guarantee. Therefore, it's crucial to consider the financial strength and reputation of the platform when evaluating the reliability of the buyback guarantee.

Swaper auto investing

Similar to many other platforms, Swaper provides an auto-invest feature that allows you to automate your loan investments. With the auto-invest feature, you can set specific criteria and preferences for your investments, such as loan amount, loan term, interest rate, and diversification settings. Swaper will then automatically allocate your funds to available loans that match your chosen criteria, saving you time and effort in manually selecting and investing in individual loans.

Swaper secondary market

Swaper also offers a convenient secondary market feature, which enables you to sell your loans before their maturity date. This flexibility allows you to manage your investments more actively and respond to changing investment opportunities. You have the option to sell either the full amount or a portion of your loan. It's important to note that certain loans may have restrictions on early sales if you have already received interest payments in advance. The secondary market provides you with additional liquidity and the ability to reallocate your funds to other investments, providing greater control over your portfolio.

Swaper loyalty bonus

Swaper offers a loyalty bonus program to incentivize larger investors. When you invest more than 5,000 Euro on the platform, you will be granted VIP status and receive an additional +2% on all your investments. This loyalty bonus is one of the most rewarding programs in the industry, providing attractive benefits for a relatively low investment amount. It's important to note that in order to qualify for VIP status and the loyalty bonus, you are required to maintain your investment for a minimum period of 3 months. This ensures a commitment to the platform and allows you to fully enjoy the advantages of the program.

Swaper Android and iPhone apps

Swaper offers a convenient mobile app for both Android and iPhone users. With the Swaper mobile app, you can effortlessly manage your investments on the go. The app provides a user-friendly interface and intuitive features that allow you to monitor your portfolio, track your earnings, and make investment decisions from the convenience of your mobile device. Whether you're using an Android or iPhone, the Swaper mobile app enables you to stay connected and in control of your investments wherever you are.

Swaper review summary

Swaper stands out as one of the top European P2P lending platforms specializing in short-term lending. It offers investors the opportunity to invest in pre-funded short-term consumer loans originating from Poland, Denmark, and Spain. With an attractive starting interest rate of 14% per annum, Swaper provides a competitive return on investment. Moreover, if you invest over €5,000, you can enjoy an additional +2% on your investments, making it even more appealing compared to other platforms.

Investor safety is prioritized on Swaper, with a reliable buyback guarantee in place for loans. The platform's financial stability adds an extra layer of security for investors. Swaper's well-designed features are user-friendly and intuitive, ensuring a smooth user experience. The auto-invest feature allows for passive investing, while the secondary market offers the flexibility to sell loans if better investment opportunities arise elsewhere.

Overall, Swaper presents a compelling option for investors seeking high returns and low investment minimums. However, it is worth noting that the platform may not be suitable for risk-averse investors due to the inherent risks associated with P2P lending.

Main takeaways from Swaper review:

Advantages:

- High returns: Swaper offers an attractive interest rate of 14%, providing the potential for lucrative returns on investments.

- Low minimum investment: with a minimum capital requirement of just €10, Swaper enables investors to get started with a small amount of money.

- Buyback guarantee: the platform provides a buyback guarantee for loans, offering an additional layer of security for investors.

- Secondary market: Swaper features a secondary market, allowing investors to sell their loans before maturity if needed.

- Auto-investing feature: Swaper offers an auto-investing feature, enabling passive investing and saving time for investors.

What to consider:

- Limited availability: Swaper is currently only available in Europe, limiting access for investors outside of the region.

- Single loan originator: all loans on the platform originate from one loan originator, Wandoo Finance Group. Some investors may prefer a greater diversity of loan originators for increased risk mitigation.