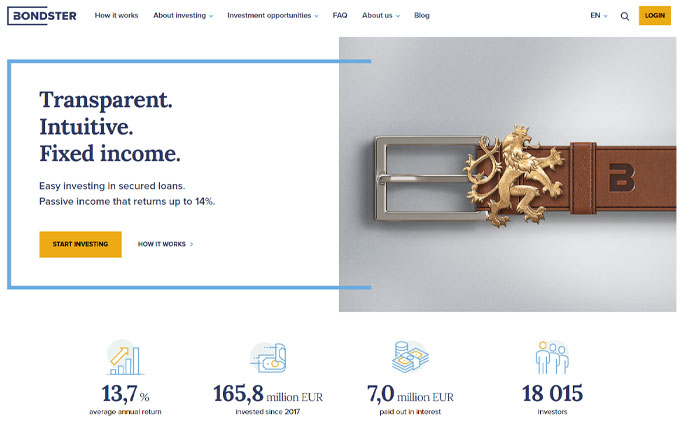

Bondster

Transparent. Intuitive. Fixed income. Easy investing in secured loans.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

13.00 %Min. investment

5 €Bondster platform review.

In this review, we'll explore Bondster, a P2P lending platform that aims to connect investors with a wide variety of lending opportunities. We'll delve into its features, investment options, risk management practices, and overall user experience. If you're considering investing in Bondster, read on to gain valuable insights.

What is Bondster?

Bondster is a Peer-to-Peer lending platform from the Czech Republic that enables investors worldwide to participate in various loan types across multiple countries. While personal loans form the core offering, Bondster also provides opportunities to invest in real estate loans, business loans, and more. Since its launch in 2017, Bondster has witnessed a growing number of funded loans, making it an attractive platform for investors. What's even better is that you can start investing with as little as €5, making it accessible to investors with different capital levels.

How does Bondster work?

Bondster is a prominent P2P marketplace that connects investors with loans from various lending companies, known as loan originators. One of Bondster's key strategic partners is ACEMA, a reputable loan originator based in the Czech Republic. The owner of ACEMA also owns Bondster. With a shared ownership structure, Bondster and ACEMA collaborate closely to offer compelling investment opportunities.

In addition to ACEMA, Bondster features loans from well-known loan originators such as LIME Zaim (RU), Rapicredit (Colombia), Kviku (RU), Right Choice (PH), and Lime (SA). This diverse range of loan originators expands the investment options available on the platform, providing investors with a broader selection of lending opportunities across different countries.

Here's how the investment journey unfolds on Bondster:

- Loan Application: borrowers apply for loans from loan originators. If approved, the loan originator disburses the loan using its own funds.

- Listing on Bondster: the loan originator partners with Bondster to list the loan on the platform for investment. Investors can then participate in funding these loans and earn potential profits.

- Attractive investment rates: to ensure the loan originator remains profitable, the loans are offered on Bondster at rates lower than what the company earns from them. This presents an opportunity for investors to benefit from attractive interest rates on their investments.

- Loan funding: as investors fund the loans on Bondster, the loan originator receives additional capital, enabling them to issue more loans and expand their lending activities.

Bondster provides a convenient and transparent platform for investors to participate in P2P lending while collaborating with reputable loan originators. However, it's important to remember that P2P lending carries inherent risks, and thorough due diligence is essential before making any investment decisions.

Types of investments available on Bondster

Bondster provides a comprehensive selection of investment opportunities designed to cater to various risk appetites and investment objectives. When you choose to invest on Bondster, you gain access to a diverse range of loans, including consumer loans, short-term loans, secured business loans (offered by ACEMA), car loans, loans backed by cryptocurrencies, and mortgages.

Investors on Bondster have the flexibility to select from different loan types, durations, and interest rates, allowing them to customize their investment portfolios according to their preferences. The platform empowers investors with detailed loan information, including borrower profiles, loan purposes, and collateral details, where applicable. This level of transparency enables investors to make well-informed investment decisions and evaluate the potential risks and rewards associated with each loan opportunity.

Whether you are seeking short-term investments or prefer more secured options backed by collateral, Bondster offers a comprehensive range of loan choices to suit your investment goals. It's important to carefully assess each investment opportunity and consider your risk tolerance and financial objectives before making any investment decisions.

Investing with Bondster

Bondster offers investors the freedom to individually select the loans they wish to invest in, providing a high level of control over their investment decisions. This feature can be particularly advantageous, especially during the initial stages of investing when you aim to deploy your funds swiftly. By hand-picking each loan, you have the opportunity to carefully assess and choose investments that align with your investment strategy and risk tolerance.

Rate of return

When investing on Bondster, you have the potential to earn an average annual return of approximately 13% on your euro investments. It's important to note that the actual return you achieve may vary depending on your investment choices and the specific loans you select.

One of the factors influencing the returns is the variance in yields, which is primarily determined by the currency in which you invest. Bondster offers loans denominated in both Czech Koruna (CZK) and Euro (EUR). By carefully considering the yield differences between these currencies, you can optimize your investment strategy to maximize your potential returns.

It's worth noting that investing in loans denominated in different currencies may present varying levels of risk and return. Factors such as currency exchange rates and economic conditions can impact the performance of investments. Therefore, it's advisable to conduct thorough research and assess the associated risks before making investment decisions.

Bondster auto investing

Similar to many other P2P platforms, Bondster offers an auto-invest feature that allows you to streamline your loan investments. With this convenient tool, you can automate your investment process, saving time and effort.

Setting up the auto-invest feature is straightforward. You define specific criteria that align with your investment goals, and the auto-investor takes care of investing in loans on Bondster that meet your chosen criteria. This hands-off approach allows you to passively invest while maintaining control over your preferences.

When configuring your auto-invest strategy, Bondster provides various options. You can select from a range of predefined investment strategies, tailored to different risk levels and objectives. Alternatively, if none of the predefined strategies suit your needs, you have the flexibility to create a custom strategy with specific settings that align with your investment preferences.

This level of customization empowers you to fine-tune your investment approach and tailor it to your unique requirements. Whether you prioritize loan terms, interest rates, loan types, or other factors, Bondster's auto-invest feature allows you to set parameters that reflect your investment strategy.

Bondster buyback guarantee

On Bondster, many unsecured personal loans come with a buyback guarantee, offered by the loan originator. This guarantee provides investors with an added layer of protection. In the event of delayed payments, the loan originator commits to repurchasing your investment and the accrued interest within a specified timeframe, typically ranging from 30 to 60 days.

However, it's crucial to be aware of the underlying risks associated with buyback guarantees. In unfortunate circumstances where the loan originator responsible for the guarantee faces financial difficulties or bankruptcy, the buyback guarantee becomes ineffective. Without a functioning loan originator, the guarantee cannot be honored, leaving investors exposed.

It's worth noting that some investors on Bondster have encountered delays exceeding the typical 60-day period. In certain instances, loan originators have chosen not to fulfill the buyback guarantee, leaving investors without recourse. Bondster, as a platform intermediary, may be unable to intervene in such situations, as it ultimately depends on the loan originator's actions.

While the buyback guarantee provides an additional level of security, it's essential to understand its limitations and the potential risks involved. Investors should conduct thorough due diligence on loan originators, assessing their financial stability and track record. Diversifying investments across multiple loans and originators can help mitigate the impact of any potential defaults or issues with buyback guarantees.

Bondster secondary market

In 2021, Bondster introduced its secondary market, providing investors with a platform to trade their loans amongst themselves. This new feature enhances investment flexibility and allows investors to adjust their portfolios according to their changing needs and preferences.

When utilizing the secondary market, there is a small fee of 0.5% imposed on loan sales. This fee ensures the smooth operation and maintenance of the platform. On the other hand, purchasing loans on the secondary market is completely free of charge, enabling investors to explore and acquire loans that align with their investment strategies without incurring any additional costs.

The introduction of the secondary market on Bondster expands the investment possibilities for users, allowing them to potentially optimize their portfolios and adapt to evolving market conditions. It provides an avenue for liquidity and the ability to adjust investments based on individual preferences, risk tolerance, and investment goals.

Brief summary and reviews of Bondster

Bondster is a reputable P2P platform that stands out in a market where many platforms originate from the Baltics. It offers investors the chance to diversify their P2P investment portfolio by venturing into the Czech Republic. With a strong commitment to due diligence, Bondster ensures a high level of seriousness in selecting loan providers.

All loan originators featured on Bondster undergo careful selection and ongoing monitoring. This meticulous approach helps maintain the platform's credibility and ensures that investors have access to reliable lending opportunities. It's worth noting that the specifics of buyback guarantees may vary depending on the loan provider. Therefore, it is recommended to pay attention to the buyback guarantees provided by each loan originator.

Bondster primarily offers loans that are backed by buyback guarantees, which provide an additional layer of security. These guarantees serve as protection against potential borrower default by allowing the loan originator to repurchase the investment and accrued interest within specific timeframes. This added safeguard offers reassurance to investors.

By diversifying your P2P investment portfolio with Bondster, you can tap into the Czech lending market and potentially benefit from its unique opportunities. The platform's commitment to selecting reputable loan providers and the prevalence of buyback guarantees contribute to the overall reliability and trustworthiness of Bondster as a P2P investment option.

Investing on Bondster allows you to broaden your investment horizons and potentially enhance your returns by exploring loans from a different geographical region. As with any investment, it's important to conduct thorough research, carefully evaluate the available loan options, and consider your risk tolerance before making investment decisions.

Overall, Bondster offers a solid track record, a commitment to selecting reliable loan providers, and the opportunity to diversify your P2P investment portfolio into the Czech Republic, making it an appealing choice for investors seeking reliable lending opportunities.

Bondster summary

Advantages:

- Offers good returns within the P2P lending market - 13%

- Minimum investment is only €5

- Auto investment feature

- Buyback guarantee on loans

What you should pay attention to:

- Buyback guarantee differs from loan to loan and not always honored by the loan originators

- 0.5% fee for selling loans on the secondary market