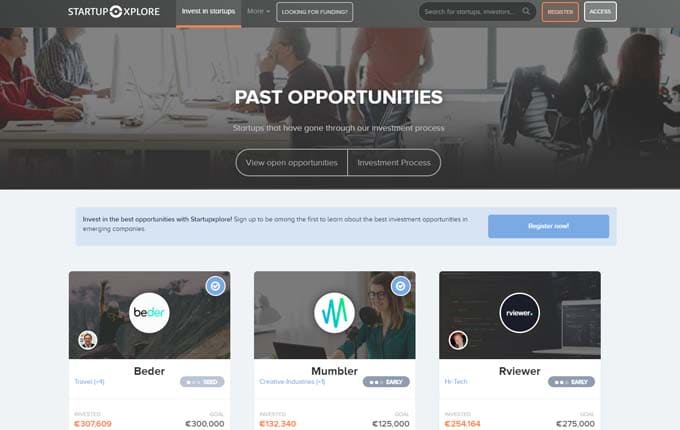

StartupXplore

We bring you top dealflow, you decide how much you want to invest.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

60.00 %Min. investment

1000 €StartupXplore review.

Welcome to our review of StartupXplore, a leading investment platform focused on startups with high growth potential. StartupXplore stands out as the largest startup community in Spain and one of the most vibrant in Europe. Through its platform, StartupXplore facilitates the connection between companies seeking investment and investors eager to support promising ventures. Join us as we delve into the diverse opportunities offered by StartupXplore and explore the potential it holds for investors and startups alike. Let's embark on this journey together and uncover the possibilities that lie ahead.

What is StartupXplore?

StartupXplore is a premier platform that offers exclusive investment opportunities in early-stage companies with tremendous growth and profit potential. These opportunities are backed by professional investors with proven experience who have already committed their capital to these ventures, alongside investments made by StartupXplore itself. As the largest startup community in Spain and one of the most dynamic in Europe, StartupXplore has swiftly become the go-to resource for discovering the finest investment prospects.

The primary focus of StartupXplore lies in its syndicate investment platform, catering to time-conscious, less experienced, and international investors. Through this platform, investors can participate in funding Spanish startups while benefiting from portfolio diversification by co-investing with a select group of highly accomplished Spanish lead investors, known for their successful track records in startup investments. StartupXplore's ultimate objective is to equip you with the necessary tools to build a diversified and well-balanced investment portfolio comprising innovative and promising companies.

How does StartupXplore work?

StartupXplore stands out from other platforms due to its vast community of investors and startups in Spain, as well as its network of renowned investors in the technology sector. These industry experts actively participate in investment projects alongside registered investors on the platform. Whether they are small savers looking to enter the world of innovative and emerging companies or larger investors seeking portfolio diversification, StartupXplore provides a platform that caters to a wide range of investment needs.

Unlike a typical marketplace, StartupXplore goes beyond mere connection between investors and project promoters. The platform takes on the role of filtering and analyzing companies that join the platform, ensuring that only those that meet stringent criteria and pass comprehensive evaluations are published and considered for investment.

While it's impossible to predict with certainty which companies will achieve success, StartupXplore focuses on identifying risk factors that could potentially lead to early-stage company failures. By applying rigorous analysis and due diligence, StartupXplore aims to offer investors the most promising investment opportunities while minimizing risks.

Types of companies to invest on StartupXplore

StartupXplore offers investment opportunities in innovative companies that possess high potential and are characterized by their lean and agile structure. These companies can be classified into three stages:

- Seed Stage: these are companies in the early phases of development. They are focused on refining their concept and creating a minimum viable product (MVP) that can be validated in the market. At this stage, their primary goal is to gather feedback and assess the viability of their business idea.

- Early Stage: companies in this stage have progressed beyond the seed stage and are actively testing their product or service. They have gathered metrics and data that allow them to iterate, incorporate user feedback, and enhance their customer acquisition strategies. They are in the process of refining their offering and preparing for further growth.

- Scale-up Stage: companies in the scale-up stage have already established a proven business model. They exhibit consistent annual turnover growth of more than 20% over a three-year period and have built a team of 10 or more employees. These companies have reached a level of maturity and stability, and they are focused on expanding their operations and capturing a larger market share.

By offering investment opportunities across these stages, StartupXplore enables investors to support companies at different phases of growth and development, potentially benefiting from their success as they progress through the various stages.

Investing on StartupXplore

Investing on StartupXplore is a straightforward and efficient process designed to provide a seamless experience. Here's how it works:

- Choose a startup: browse through the available start-ups or growth companies on the platform and select the one you wish to invest in. Each opportunity has undergone a pre-screening process by StartupXplore, ensuring the quality and reliability of the investment options.

- Determine your investment amount: decide how much you want to invest in the chosen start-up. The minimum investment amount typically starts at €1000, allowing investors with various budgets to participate.

- Online investment process: the entire investment procedure takes place online, making it convenient and accessible. You can complete the investment process within a few minutes from the comfort of your own home or office.

- Review start-up details: the start-up's dedicated page provides comprehensive information to help you make an informed investment decision. This includes details about the participation terms, a thorough description of the start-up, an introductory video, the start-up's expectations and future plans, as well as the pooling agreement and participation contracts.

- Make the investment: once you have finalized your investment decision and selected the desired investment amount, proceed to provide your user information and choose the payment method. StartupXplore will then provide you with the necessary contracts for your records.

- Confirmation and completion: your investment will be confirmed by StartupXplore after they have received the investment amount. You will receive the relevant documentation, officially acknowledging your participation in the chosen start-up.

By offering a user-friendly and efficient online platform, StartupXplore simplifies the investment process, making it accessible to investors seeking opportunities in promising start-ups and growth companies.

What are the risks?

Investing in start-ups involves certain risks due to the nature of these organizations and their search for a scalable and global business model. While some start-ups may fail, a few may generate profits, and only a select few may yield a high return on investment. It's important to understand that investing in emergent companies with high potential for revaluation is considered a high-risk investment product, but it also offers the possibility of high returns.

Given the inherent risk associated with these types of investments, it is crucial to exercise caution and not allocate a significant portion of your assets. It is advisable to only invest an amount that you can afford to lose without compromising your financial stability. It is essential to carefully assess your risk tolerance and diversify your investment portfolio to mitigate potential losses.

It is important to note that any investor who chooses to invest in one or more companies with high growth potential through StartupXplore should be fully aware of the high degree of risk involved. It is recommended to thoroughly evaluate the investment opportunities, conduct due diligence, and seek professional advice if needed before making any investment decisions. By acknowledging the risks associated with investing in start-ups, investors can make informed choices and approach these investments with a realistic understanding of the potential outcomes.

StartupXplore review summary

StartupXplore is a leading crowdfunding platform that focuses on startups and boasts a large community of investors. Investing in startups through this platform differs from traditional investments in terms of higher volatility in returns. While there is potential for significant profits, it's important to acknowledge that startup performance can be unpredictable, leading to variability in portfolio outcomes.

As an online platform, StartupXplore provides an avenue for individuals, including average investors, to actively support promising startups. Entrepreneurs can showcase their business ideas on StartupXplore, while investors have the opportunity to contribute funds in exchange for equity in these companies.

When participating in startup investing, it's crucial to have a comprehensive understanding of the associated risks. Adopting a strategy of diversification is key to mitigating the potential impact of individual business outcomes. Like any investment, careful evaluation, thorough research, and a long-term perspective are vital when navigating the opportunities and challenges presented by investing platforms such as StartupXplore.

StartupXplore pros and cons

Advantages:

- Democratization of investment opportunities: StartupXplore allows average investors to participate in the early stages of promising startups, breaking down barriers that previously limited such investments to wealthy individuals.

- User-friendly platform: StartupXplore offers a user-friendly platform that simplifies the process of exploring investment opportunities. Investors can easily navigate the platform and select projects that align with their interests and investment objectives.

Points to consider:

- Inherent risks: investing in startup companies inherently carries risks. It's important to recognize that there is no guarantee of a return on investment. The nature of these investments means that outcomes can be uncertain, and investors should carefully assess the potential risks involved before committing funds.