HeavyFinance

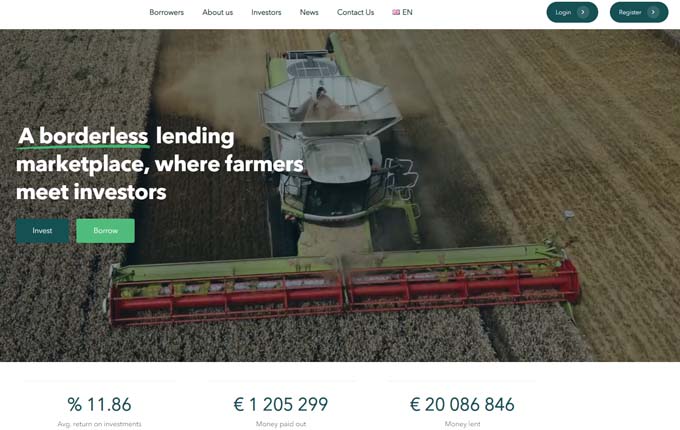

A borderless lending marketplace, where farmers meet investors.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

11.87 %Min. investment

100 €HeavyFinance investment platfrom

HeavyFinance is a specialised crowdfunding platform established in Lithuania in 2020 to invest in agricultural loans with heavy equipment collateral. The HeavyFinance platform connects European Union farmers looking for financing opportunities with investors. In its relatively short lifetime, the platform has already earned the trust of many investors. The HeavyFinance platform has 4,000 active investors who have already helped to finance more than 600 loans to European farmers totalling more than €20 million. The platform is supervised by the Bank of Lithuania, so all HeavyFinance's financing processes are controlled by the relevant state authorities. Read HeavyFinance's testimonials and a detailed overview of the platform.

HeavyFinance investing platform overview

The HeavyFinance platform works through crowdfunding, where agricultural loans are financed by many different investors from all over Europe. All the loans offered by this investment platform are secured by collateral for heavy machinery or by a personal guarantee from the farm owner. It is important to note that the HeavyFinance platform acts as an intermediary between farmers and investors and does not issue loans itself. HeavyFinance has a historical return on investment of around 12% and the average term of loans financed is 28 months. The platform has opened offices in Poland, Portugal and Bulgaria.

HeavyFinance buyback guarantee

The HeavyFinance investment platform does not provide a Buyback Guarantee for loans in arrears. On the other hand, all loans financed on this platform are secured by a pledge of heavy machinery or a personal guarantee from the farmer. Therefore, even if the borrower defaults on the loan, the investors' interests are sufficiently protected. Heavy machinery is a highly liquid asset on the market and in the event of the borrower's insolvency, the pledged assets can be sold quickly.

HeavyFinance secondary market

The HeavyFinance platform has a secondary market where investors can sell their investments or buy them from other investors. When investments are sold, the seller is charged a fee of 1% of the value of the investment sold. The services of the secondary market are free of charge for buyers. Liquidity on the secondary market depends on the activity of the investors registered on the platform, so selling an investment may sometimes have to wait for other investors to show interest.

HeavyFinance autoinvesting feature

The HeavyFinance platform has an automatic investment function, the benefits of which can be used by all investors registered here. Using the automatic investment function, investors can set acceptable criteria for project risk, investment duration, interest rate, collateral value or LTV in advance. Subsequently, the automated investment system itself selects all eligible projects and invests a set amount of money in them. You can turn off the automatic investment feature or change its settings at any time.

Accountability

The HeavyFinance website provides a summary of the platform's performance. They are available at: https://heavyfinance.com/statistics/. Here you can see statistics on the loans financed by the platform and the overall dynamics of the loan portfolio. HeavyFinance does not publish its audited annual accounts.

Investing on the HeavyFinance platform

The HeavyFinance platform allows you to invest in business loans for farmers secured by heavy machinery collateral or a personal guarantee from the farmer. The platform is managed by strong

specialists in their respective fields, with extensive experience in both the development of investment platforms and the sale of heavy machinery. It should be noted that the HeavyFinance platform does not carry out any financial operations itself. The platform acts as an intermediary between investors and farmers seeking financing.

HeavyFinance investing - registration, account and first steps

Before you can start investing on the HeavyFinance platform, you need to register and complete the authentication procedure. You can verify your identity using the Paysera or LemonWay payment systems. Thus, you need to have an account with Paysera or LemonWay to invest on the HeavyFinance platform. Once all the required details have been provided, the investor's personal account is confirmed and the investment can start.

Before investing, you need to fund your Paysera or LemonWay account with investment funds and familiarise yourself with the investments published on the platform. Historical investment returns on the HeavyFinance platform average around 12%, with a minimum investment of €100 per property. Interest on the loan is paid to investors according to a pre-approved payment schedule, usually on a monthly basis. The loan is repayable at the end of the loan term or in instalments, together with periodic interest payments.

HeavyFinance reviews and summaries

Benefits:

- The platform is supervised by the Bank of Lithuania

- A functioning secondary market

- The average historical annual return to investors is 12%.

- Financed loans are secured by heavy machinery or a personal guarantee

- Start investing from just €100

What to look out for:

- 1% fee on the sale of an investment on the secondary market

- To start investing, you must have an account with Paysera or LemonWay payment systems

- No buyback guarantee

- An administration fee of 0.1% of the overdue amount per day is applied to the borrower's overdue payments under the loan agreement.