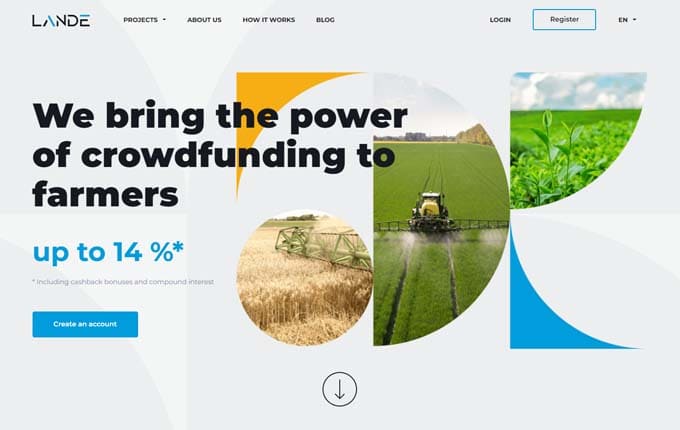

Lande

We bring the power of crowdfunding to farmers.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

12.00 %Min. investment

50 €Overview of the Lande platform.

Lande (formerly LendSecured) is a crowdfunding platform established in Latvia, which provides an opportunity to invest in agricultural projects of small and medium-sized businesses and earn interest from the interest paid. The platform brings together farmers looking for funding and investors looking to put their money to work. It should be noted that in a relatively short period of operation, the Lande platform has already gained the trust of a large number of investors from across the European Union. More than 1200 investors from all over Europe are currently investing in the platform and have collectively financed more than 160 agricultural projects. We invite you to take a closer look at Lande’s activities and the opportunities for investing in businesses in the agricultural sector on this platform.

Investing with the Lande platform

As we have already mentioned, the Lande investment platform is based on the principle of crowdfunding, where projects being developed on the platform are funded by a large number of different investors rather than just one. All the loans issued on the platform are secured by collateral, such as a mortgage on real estate, a personal guarantee from a farmer or even a future harvest. Lande invests at least 5% of its own funds in each project it finances, which significantly increases the confidence of investors in the platform's administration. The average return on investment on the platform is around 12% and loans are issued for a term of 6 to 24 months. Lande also has extremely low LTVs for investment projects, with an average LTV of 40%.

Lande buyback guarantee

The Lande platform does not provide a buyback guarantee for late loans. On the other hand, all loans issued on the platform are secured by collateral or a guarantee, which allows to strongly protect the investors' interests in the event of financial difficulties of the borrower. In addition, the extremely low LTV ensures that the proceeds of the sale of the collateral will fully cover all the borrower's outstanding liabilities.

Lande secondary market

The Lande platform has a secondary market, which greatly increases the liquidity of investments. The secondary market allows investors to buy and sell investments from each other. The use of the secondary market is free for both buyers and sellers. Please note that the liquidity of the secondary market is mainly dependent on the activity of the investors themselves, so that a suitable transaction may sometimes have to wait.

Lande autoinvesting feature

Lande has an automatic investment feature that can be used by all users of the platform. With the automatic investment function, investors can pre-determine acceptable investment criteria according to which the system should select suitable projects for investment. Subsequently, the automated investment system itself invests the intended amount of money in eligible projects. The automatic investment function can be switched off or its desired settings can be changed at any time.

Lande accountability

Lande provides information on its performance on its website. Summarised and monthly performance indicators are available at: https://lande.finance/en/statistics. Here you can find statistics on projects financed by investors and the overall performance of the platform's loan portfolio. Lande also provides annual performance reports on its website, which significantly increases the transparency of the platform's activities: https://lande.finance/en/transparency.

Investing on the Lande platform

The Lande platform allows you to invest in loans issued to small and medium-sized farmers, which are secured by collateral, a guarantee or a future harvest. The platform presents only low-risk projects with very low LTVs to its investors. The average LTV of all projects financed on the platform is only 40%. Lande is also distinguished by its relatively flexible investment terms. The financing terms of projects featured on the platform are usually between 6 and 24 months, which makes it suitable for both long-term and short-term investors.

Lande investing - registration and first steps

Before you can start investing on the Lande platform, you first need to register and verify your identity. Identity can be verified using the LemonWay payment system. The LemonWay system will also open a virtual payment account for you to use to transfer funds for investment. Once you have provided all the required data and documents, your personal investor account will be approved.

The historical annual investment return on the Lande platform is around 12%. The interest and the loan portion are paid to investors according to a pre-approved payment schedule. With a minimum investment of just €50, almost anyone can start investing on Lande.

Lande overview and summaries

Benefits:

- Use of the secondary market is completely free of charge

- Low LTV rate

- Loans financed are secured by collateral, a guarantee or a future harvest

- Start investing from just €50

What to look out for:

- To start investing, you need to create an account in the LemonWay payment system

- The platform does not provide a redemption guarantee