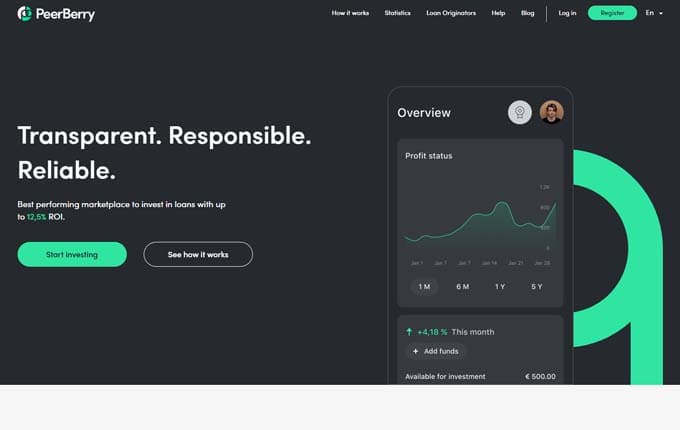

PeerBerry

Transparent. Responsible. Reliable.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

11.00 %Min. investment

10 €PeerBerry platform overview.

If you are considering investing through PeerBerry, we have prepared this overview to help you in your decision-making process. It is essential to understand that the following review is based on our own analysis and should not be considered as financial advice. Our aim is to provide a thorough assessment of the advantages and disadvantages of PeerBerry, enabling potential investors to evaluate whether this platform aligns with their investment objectives. The information provided here serves as a starting point to understand the key features and considerations associated with PeerBerry.

What is PeerBerry?

PeerBerry is a Peer-to-Peer lending platform that primarily focuses on providing short-term consumer loans. While the platform is legally based in Croatia, its operations are conducted from Lithuania. PeerBerry is owned by the Lithuanian-based payday lender Aventus Group. Initially, Aventus Group utilized other P2P platforms to acquire liquidity for additional loans. However, in 2017, the company decided to establish its own P2P lending platform, which led to the creation of PeerBerry.

For investors seeking high-yield opportunities in short-term loans, PeerBerry proves to be an excellent P2P lending platform. It's important to note that short-term investments are generally considered to carry higher risk compared to long-term investments. When you invest through PeerBerry, your funds are allocated to unsecured consumer loans that have already been issued. These loans are referred to as pre-funded loans, meaning they have already been funded before being made available for investment on the platform.

How does PeerBerry work?

PeerBerry operates as a loan marketplace where investors have the opportunity to finance consumer loans that are originated by various loan companies. The platform collaborates with several loan originators, including Aventus Group, Gofingo, Lithome, and SIB Group. While the majority of loans available on PeerBerry are short-term loans, there are also options for leasing, business, real estate, and long-term loans.

The loan originators affiliated with PeerBerry make the loans they have issued to consumers available for investment on the platform. As an investor, you have the chance to invest in these loans and earn a return on your investment. By investing in the loans via PeerBerry, you provide additional liquidity to the lending companies. This increased liquidity allows the lending companies to issue more loans and expand their business operations.

Loan originators

PeerBerry has partnerships with two prominent finance groups, Gofingo and Aventus Group, as well as two smaller lenders, Lithome and SIB Group. Through these collaborations, investors on PeerBerry have the opportunity to invest in loans from a total of 23 loan originators. This wide range of loan originators provides investors with a diverse selection of loans to choose from, increasing the potential for portfolio diversification.

How does PeerBerry make money?

PeerBerry generates revenue by earning commissions from the lenders who list their loans on the platform. The commission is typically based on the volume of funded loans, meaning that as the loan volume increases, PeerBerry's revenue also increases. This business model aligns the platform's success with the success of its lenders and encourages PeerBerry to attract more loan originators and facilitate a larger volume of loan investments.

Investing with PeerBerry

To register on PeerBerry, you must meet certain requirements. Firstly, you need to be at least 18 years old and reside within the European Economic Area. Additionally, you must have a personal bank account in your name from the country where you are a resident. PeerBerry also provides the option to open a business account if you are interested. The registration process is straightforward and typically takes less than 5 minutes to complete. It involves filling out a registration form with the required information to create your PeerBerry account.

Rate of return

Investors on PeerBerry have the potential to earn an average return of 11%. This return is slightly higher compared to other peer-to-peer (P2P) platforms that offer similar investment opportunities. However, it's important to note that higher returns come with inherent risks.

PeerBerry buyback guarantee

All loans listed on PeerBerry come with a 60-day buyback guarantee, which means that the loan originator is obligated to repurchase the loan if the borrower fails to repay within 60 days. This provides an added layer of security for investors. In the event that the borrower becomes more than 60 days late on the repayment schedule, the loan originator will repurchase the loan from the investor, including paying any accrued interest.

However, it's important to understand that the buyback guarantee does not guarantee 100% safety of the investments. The effectiveness of the buyback guarantee depends on the financial stability and reliability of the loan originator. If a loan originator were to go bankrupt, the buyback guarantee provided by that specific loan originator would no longer be applicable.

Therefore, while the buyback guarantee offers some level of protection, investors should still consider the overall financial health and track record of the loan originators before making investment decisions on PeerBerry. Diversification and thorough research are key to managing risks in P2P lending platforms like PeerBerry.

PeerBerry group guarantee

PeerBerry provides an additional guarantee through the parent companies of the loan originators. Many of the loan originators on PeerBerry operate in multiple countries and are owned by two major investment groups, namely Aventus Group and Gofingo. Although the loan originators function as independent entities, the additional guarantee ensures that if a loan originator is unable to fulfill the buyback guarantee, the parent company will intervene and repurchase the claims from investors.

This additional guarantee adds another layer of security to the investments made on PeerBerry. It provides reassurance that even if a specific loan originator faces financial difficulties, the parent company will step in to honor the buyback guarantee and ensure investors' claims are repurchased.

However, it's important to note that while this additional guarantee offers an extra level of protection, it does not eliminate all risks associated with investing. Investors should still conduct their due diligence, assess the financial strength of the loan originators and parent companies, and diversify their investments to manage potential risks effectively.

PeerBerry auto investing

PeerBerry offers the convenience of auto-invest functionality, which allows investors to automate their investments and participate in a more passive manner. Given that the majority of loans on PeerBerry are short-term in nature, utilizing the auto-invest feature is highly recommended to save time and streamline the investment process.

With the auto-invest feature on PeerBerry, investors have the flexibility to set important parameters according to their preferences. These include defining the portfolio size, setting the maximum investment amount per loan, selecting desired interest rates, loan periods, loan statuses, countries, and loan originators. Additionally, there is an option to automatically reinvest all the returns generated from the investments.

By utilizing the auto-invest feature, investors can ensure that their funds are consistently deployed based on their chosen criteria, allowing for a more efficient and hassle-free investment experience on PeerBerry.

PeerBerry fees

PeerBerry stands out by not applying any service, deposit, or withdrawal fees to its users. This means that investors can enjoy the platform's features and functionalities without incurring any additional costs. There are no restrictions on the amount that can be deposited into a PeerBerry account, providing flexibility for investors to contribute according to their preferences.

When it comes to withdrawing funds, PeerBerry allows users to transfer their funds back to the bank account from which the initial deposit was made. It's important to note that there is a minimum withdrawal requirement, which should be no less than 1 EUR. This ensures that investors can access their funds when needed, while still maintaining a reasonable threshold for withdrawals.

PeerBerry loyalty program

PeerBerry offers a unique loyalty program that distinguishes it from many other platforms. The PeerBerry loyalty program is designed to reward investors who invest significant capital through the platform for extended periods of time.

The loyalty program consists of three different levels, each offering its own bonus based on the portfolio size:

- Silver Level: Investors with portfolios exceeding €10,000 qualify for the Silver level and receive a 0.5% bonus.

- Gold Level: Investors with portfolios surpassing €25,000 qualify for the Gold level and receive a higher bonus of 0.75%.

- Platinum Level: Investors with portfolios exceeding €40,000 qualify for the highest level, Platinum, and receive a generous bonus of 1%.

These loyalty bonuses serve as a token of appreciation from PeerBerry to its loyal investors, providing an additional incentive to continue investing and maintaining long-term partnerships with the platform.

PeerBerry Android and iPhone apps

PeerBerry provides a user-friendly mobile app for both Android and iPhone users, offering a convenient way to access the platform and manage investments on the go. The PeerBerry mobile app stands out as one of the top apps in the industry, providing a seamless user experience comparable to the desktop version.

With the PeerBerry mobile app, investors can perform the same functions as on the desktop platform, all within a well-designed and intuitive interface. The app allows you to efficiently oversee your portfolio, providing a quick overview of essential information such as available funds, invested funds, paid interest, and annualized net return.

Whether you're an Android or iPhone user, the PeerBerry mobile app enables you to stay connected and informed about your investments, empowering you to make timely decisions and manage your PeerBerry account conveniently from your mobile device.

PeerBerry review summary

PeerBerry is currently considered one of the top P2P lending platforms for short-term investing. Most investments on the platform typically have a duration of around 30 days, allowing investors to withdraw their capital within a month, unless there are delayed loans in their portfolio. To provide an added layer of protection, PeerBerry offers a 60-day buyback guarantee, which means that if loans become delayed, PeerBerry will repurchase them after 60 days.

One of the strengths of PeerBerry is its user-friendly interface, making it easy for investors to navigate and utilize the platform. The auto-invest function further enhances the investing experience, allowing investors to automate their investments according to their chosen criteria. These features contribute to making PeerBerry a pleasant and convenient platform to use.

It's important to note that PeerBerry has some limitations that investors should be aware of. One drawback is the absence of a secondary market, which means investors cannot easily sell their investments before their maturity date. However, since most loans on PeerBerry have short durations, this limitation may not be a significant concern for the majority of investors.

Overall, PeerBerry is a solid P2P lending platform that caters to investors seeking higher returns. It is important to acknowledge that investing through PeerBerry involves assuming additional risk, but for those comfortable with this aspect, PeerBerry offers a reliable platform to explore and potentially achieve their investment goals.

Main takeaways from PeerBerry review

Advantages:

- Attractive returns: PeerBerry offers a solid interest rate of 11%, providing the potential for favorable investment returns.

- Low minimum investment: with a minimum capital requirement of just €10, PeerBerry allows investors to start with a small amount of money, making it accessible to a wide range of individuals.

- Buyback guarantee: PeerBerry provides a 60-day buyback guarantee for loans, offering an added layer of security and reassurance for investors.

- Auto-investing feature: the platform offers an auto-investing feature, allowing investors to automate their investments and enjoy a passive investing approach. This feature saves time and simplifies the investment process.

- Mobile app availability: PeerBerry offers a mobile app for convenient access and management of investments on the go.

What to consider:

- No secondary market: PeerBerry does not have a secondary market, which means that investors may have limited liquidity for their invested capital. It's important to consider this if you anticipate needing quick access to your funds before the loan maturity period.