Top P2P websites for investors: the best peer-to-peer lending sites to grow your money

Discover the top P2P lending websites for investors, including the best peer-to-peer lending sites and platforms with high returns. Learn how to invest in P2P lending, compare, minimize risks and maximize your profits. Our guide covers the best peer-to-peer sites with high returns, diversification opportunities, and investor protection.

Are you an investor looking for high returns and diversification opportunities? If so, you might want to consider peer-to-peer (P2P) lending as an alternative investment option. P2P lending enables individuals to lend money to borrowers without going through traditional financial institutions. In recent years, peer-to-peer lending has gained popularity among investors seeking higher returns than those offered by traditional investments such as savings accounts and bonds. However, with so many P2P websites available, it can be challenging to determine which P2P platforms in Europe are trustworthy and offer the best returns. In this article, we'll provide an overview of the best P2P websites for investors and share tips for successful investing in P2P lending.

Importance of P2P websites for investors

Peer-to-peer (P2P) lending has become a popular alternative investment option for investors looking for higher returns than those offered by traditional investments. P2P lending enables individuals to lend money for interest without going through banks or other financial institutions. This creates a unique opportunity for investors to earn high returns on their investments while helping borrowers obtain financing for various purposes. P2P websites serve as platforms that connect borrowers with investors, offering a win-win situation for both parties.

The importance of P2P websites for investors lies in the diversification opportunities and potentially higher returns they offer. P2P lending allows investors to spread their investments across a range of loans, minimizing the risk of loss due to default by any single borrower. Additionally, P2P websites often offer competitive interest rates on loans, providing investors with the opportunity to earn higher returns than those offered by traditional investments such as savings accounts and bonds.

Furthermore, P2P lending offers a more streamlined and efficient process than traditional lending. By eliminating the need for intermediaries such as banks, P2P lending reduces the time and cost associated with the lending process. This efficiency benefits both borrowers and investors, as borrowers can obtain funding more quickly, and investors can start earning returns sooner.

So, P2P lending has become an increasingly attractive investment option for investors seeking high returns and diversification opportunities. P2P websites provide a convenient and efficient platform for investors to lend money for profit to borrowers while earning competitive returns. In the following sections, we'll delve deeper into the criteria for selecting a P2P website, compare the top platforms, and provide tips for successful investing in P2P lending.

Selecting best P2P websites for investors

When selecting top P2P websites for investors, there are several factors to consider. These include platform reputation and trustworthiness, investor protection and risk management, diversification opportunities, returns on investment, and accessibility and ease of use.

First and foremost, the reputation and trustworthiness of a P2P website is crucial. Investors should choose platforms that have a proven track record of success and are well-established in the market. Look for platforms that have been operating for several years and have a solid reputation in the industry. Doing your due diligence and researching the platform's history, management team, and customer reviews can help you make an informed decision.

Investor protection and risk management are also very important considerations. Choose P2P websites that have robust risk management protocols in place to protect investors from potential losses due to borrower defaults or other risks. Look for platforms that offer features such as borrower credit checks, loan diversification, and collection and recovery processes.

Diversification opportunities are critical when selecting top P2P website. Diversifying your investments across multiple loans can help mitigate risk and increase your chances of earning consistent returns. Choose platforms that offer a variety of loans across different risk levels, loan types, and borrower profiles.

Returns on investment are, of course, a primary consideration for investors. Compare the interest rates and fees offered by different P2P websites to determine which platform offers the best returns for your investment. Keep in mind that higher returns typically come with higher risks, so it's important to strike a balance between risk and return.

Lastly, accessibility and ease of use are essential considerations when selecting a P2P website. Choose platforms that are easy to navigate and use, with intuitive interfaces and robust customer support. Look for platforms that offer mobile apps or web-based platforms that allow you to manage your investments from anywhere, at any time.

So, when selecting the best P2P websites for investors, consider the platform's reputation and trustworthiness, investor protection and risk management, diversification opportunities, returns on investment, and accessibility and ease of use. By carefully evaluating these factors, you can choose a platform that meets your investment goals and risk tolerance while providing a convenient and profitable investment opportunity.

List of top P2P lending sites for investors

Mintos

Mintos is a popular peer-to-peer lending site that was founded in 2015 and has quickly become one of the largest in Europe. The platform operates in multiple countries and offers loans in various categories, including personal, car, mortgage, and business loans. Investors can choose to invest manually or through an auto-invest feature that automatically diversifies their portfolio based on their criteria. Mintos also offers a secondary market that allows investors to buy and sell their investments before the loan term is up, providing added liquidity and flexibility. Additionally, Mintos provides a buyback guarantee on some loans, which protects investors against borrower default. Overall, Mintos is a well-established and reputable P2P platform with a range of loan options and features for investors, making it worth considering for those looking to diversify their portfolio and potentially earn higher returns than traditional investment options.

Viainvest

Viainvest is a P2P investment website headquartered in Latvia that links investors with borrowers from different European countries. Its simple user interface and attractive returns have made it popular among investors since its establishment in 2016. With a minimum investment of €10, investors can earn returns ranging from 9% to 12% depending on the borrower's creditworthiness and the loan type. Most of Viainvest's loans come with a buyback guarantee, protecting investors against borrower defaults. The platform is overseen by the Financial and Capital Market Commission of Latvia, and is regarded as one of Europe's top P2P lending platforms.

Bondster

Bondster is a European P2P site that connects investors with loans issued by non-bank financial institutions. The platform provides loans from various loan originators in countries such as the Czech Republic, Slovakia, and other European nations. Bondster offers a low minimum investment requirement for investors and an Auto Invest feature. Additionally, the platform has a secondary market for buying and selling loans, providing flexibility and liquidity for investors. The minimum investment amount is only €10, making it accessible to a wider range of investors. Bondster is an excellent option for those seeking to diversify their portfolio with European P2P loans.

Twino

Twino is a trustworthy peer-to-peer lending site that allows investors to fund personal loans across multiple European countries. Founded in 2009, the platform has funded over €1.2 billion in loans. Investors can choose from various loans with different interest rates and risk levels. One of the platform's unique features is the buyback guarantee, where Twino buys back the loan from the investor if it's overdue by more than 60 days. Twino also offers an auto-invest feature and a low minimum investment of €10. Investors can withdraw their funds at any time without any penalties. While Twino is a reliable platform, investors should always do their research and understand the risks associated with P2P lending.

Kviku Finance

Kviku is a European P2P lending website that focuses on short-term loans. Established in 2017 and based in Estonia, Kviku operates in several European countries including Lithuania, Spain, and Russia. Its user-friendly interface makes investing easy, and investors can start with as little as €10. The platform offers competitive interest rates on short-term loans, with investment terms ranging from 30 to 90 days. One of the platform's standout features is the buyback guarantee, which offers protection to investors in case of borrower default. Additionally, Kviku provides a secondary market where investors can sell their investments to others, increasing liquidity and flexibility. Overall, Kviku is a reliable choice for investors seeking a P2P platform that specializes in short-term loans, and its transparency makes it a trustworthy investment opportunity.

Debitum Network

Debitum Network is a P2P site based in Latvia that connects investors with small and medium-sized businesses. Launched in 2018, the platform has facilitated loans worth millions of euros and has simplified the process of securing funding for SMEs by eliminating the need for traditional banks and other financial institutions. Investors can choose from a variety of loans, including short-term, invoice financing, and asset-backed loans. With a minimum investment of just €10 and interest rates ranging from 8% to 11%, Debitum Network provides an accessible and attractive investment opportunity. Additionally, the platform offers a buyback guarantee, which means that investors are protected in case a loan becomes overdue by more than 90 days.

Lendermarket

Lendermarket is a P2P site that lets investors invest in short-term loans issued by Creditstar Group, a consumer finance provider in Europe. Loans are typically unsecured and have a maturity of up to 60 days, issued to borrowers in Spain, Poland, and the Czech Republic. Lendermarket has a buyback guarantee on all loans that are delayed by more than 60 days, and offers a simple and user-friendly platform with a minimum investment of €10. The platform also offers an auto-invest feature and interest rates on loans range from 12% to 14%. Overall, Lendermarket is a great option for investors looking to invest in short-term loans with competitive interest rates and no fees.

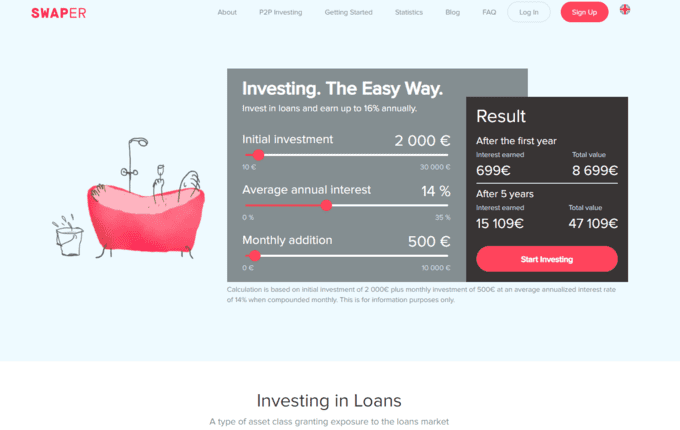

Swaper

Swaper is a Latvian-based peer-to-peer website that offers investors an opportunity to invest in consumer loans. With a user-friendly interface, Swaper offers only one investment type - consumer loans - which are pre-funded by the platform. Investors can manually select loans or use the auto-invest feature. Swaper offers solid returns of up to 14% on certain loans, with an average return of 12%. There is also a secondary market where investors can sell their loans, for a fee of 2%. Swaper provides a buyback guarantee on loans that are more than 30 days overdue, providing extra security for investors.

Bondora

Bondora is a well-established P2P platform that provides investors with an opportunity to invest in loans from Estonia, Finland, and Spain, with a minimum investment of just €1. The loan portfolio includes personal loans, car loans, and small business loans. Bondora offers an auto-invest feature and a "Portfolio Pro" tool that allows investors to create custom portfolios with specific criteria. The platform also offers a secondary market, but it may not be suitable for all investors as it can be illiquid. Overall, Bondora is a reliable and user-friendly platform with a long track record of success.

Savy

Savy is a Lithuanian P2P site that connects investors with borrowers. Founded in 2014, it offers personal, car, and business loans. The platform is user-friendly and allows investors to track their investments on-the-go. To reduce investment risk, Savy offers a buyback guarantee that ensures investors get their principal investment back if the borrower defaults. With a minimum investment of €10, investors can expect returns up to 12%. Overall, Savy is a reliable and transparent platform for those interested in investing in the Lithuanian P2P market.

Paskolų klubas

Paskolų klubas is a peer-to-peer platform based in Lithuania that connects investors with borrowers. Investors can invest in loans offered to individuals and businesses with different credit ratings and loan terms, with a minimum investment of just €20. The platform offers a buyback guarantee, which means that if a borrower defaults on their loan, the platform will buy back the loan from the investor. Investors can expect to earn returns of up to 12% on their investments. Overall, Paskolų klubas is a reliable and transparent platform for investors looking to invest in lending with a buyback guarantee.

Finbee

Finbee is a peer-to-peer investing site that started in Lithuania in 2015. It lets investors invest in loans issued to individuals and businesses. Finbee has a range of loan options including consumer loans, business loans, and invoice financing. The minimum investment amount is only €5 and investors can earn returns of up to 14%. Finbee also offers a secondary market where investors can sell their investments to others, making it more liquid. Additionally, the platform has an automatic investment feature which invests your funds according to criteria you set. Overall, Finbee is a great option for investors who want to expand their portfolio with Lithuanian peer-to-peer loans.

Tips for successful investing in P2P lending

Peer-to-peer (P2P) lending has become an increasingly popular investment option for individuals looking to diversify their portfolios and earn high returns. With the rise of online websites that connect borrowers with investors, P2P lending has become more accessible and user-friendly than ever before.

However, like any investment, P2P lending carries risks and requires careful consideration and management to ensure success. Here we will provide some tips for how to invest in P2P loans, including understanding the risks and rewards, creating a diversified portfolio, conducting due diligence on borrowers and platforms, monitoring and managing investments, and maximizing returns.

Understanding risks and rewards

Before investing in any P2P lending, it is important to understand the potential risks and rewards. While the potential for high returns may be attractive, it is essential to remember that P2P lending is not without risk. The risks associated with P2P lending include borrower default, platform bankruptcy, and interest rate risk. Borrower default is the risk that a borrower will fail to repay their loan, resulting in a loss of principal for the investor. Platform bankruptcy is the risk that the P2P lending platform itself will go bankrupt, resulting in a loss of investor funds. Interest rate risk is the risk that interest rates will rise, resulting in lower returns for investors.

On the other hand, the potential rewards of P2P lending include higher returns compared to traditional investments, the ability to diversify investments, and the opportunity to invest in businesses and individuals who may not be able to access traditional sources of financing. To minimize risk, it is important to do your research and invest in reputable and the best P2P lending platforms with a proven track record of success. Additionally, creating a diversified portfolio can help to spread risk across multiple loans and borrowers, reducing the impact of any individual default.

Creating a diversified portfolio

One of the keys to successful investing in P2P lending is to create a diversified portfolio. Diversification means spreading your investments across a variety of loans and borrowers to minimize risk. To achieve diversification, you should invest small amounts in multiple loans and borrowers rather than investing a large amount in a single loan or borrower. This reduces the risk of losing your entire investment if a borrower defaults on their loan.

Investors should also consider diversifying across multiple P2P lending platforms to spread risk. By investing in multiple platforms, you reduce the risk of a single platform's failure affecting your entire portfolio. Additionally, investors should diversify across loan types, borrower profiles, and loan grades. By investing in a variety of loan types such as personal loans, business loans, and real estate loans, and across different borrower profiles such as prime borrowers and subprime borrowers, investors can further minimize risk.

Monitoring and managing investments

Once you have created a diversified portfolio of P2P loans, it is important to regularly monitor and manage your investments. This involves keeping track of your loans performance, ensuring that borrowers are making timely payments, and taking appropriate action if necessary. Most P2P lending platforms provide investors with tools to track their investments, such as dashboards and performance reports. It is important to review these regularly to stay up-to-date on the status of your loans and identify any potential issues.

If a borrower is late on a payment, it is important to take action promptly. Many investment platforms in Europe have automated processes in place to handle late payments, such as sending reminders to the borrower or even initiating collections procedures. As an investor, it is important to stay informed about these processes and take action when necessary to protect your investment.

In addition to monitoring individual loans, it is important to regularly review your portfolio as a whole. This can help you identify trends in loan performance and make adjustments to your investment strategy as needed.

Final recommendations and suggestions

Investing in P2P lending can be a rewarding experience if done correctly. Here are some final recommendations and suggestions to help you make the most of your P2P lending investments:

- Start small: it’s always a good idea to start with a small investment and gradually increase it as you get more comfortable with the platform and its risks.

- Choose reputable websites: stick to the best P2P websites for investors with a proven track record and reputation for trustworthiness, investor protection, and risk management.

- Diversify your portfolio: invest in loans across different borrower types, risk grades, and loan terms to spread your risk and minimize losses.

- Conduct thorough due diligence: before investing in a loan, examine the borrower’s credit history, income, and other relevant factors. Likewise, research the platform's underwriting practices and track record.

- Monitor and manage your investments: regularly review your portfolio performance and adjust your investments as necessary. Keep track of any missed payments or defaults and take prompt action when necessary.

- Maximize returns and minimize losses: choose a mix of loans with high yields and low risk and manage your portfolio accordingly.

By following these tips, you can potentially generate solid returns while minimizing your risk exposure in peer-to-peer investing. Remember that investing always carries risk, but with due diligence and care, you can manage that risk effectively and grow your wealth over time.