The best P2P platforms in Europe: a comprehensive guide to peer-to-peer investing

Looking for the best P2P platforms in Europe? Look no further! Our comprehensive guide compares the top Peer-to-peer investing platforms, providing insights on features, benefits, and potential returns. Discover the right P2P platform for your investment needs today.

Peer-to-peer investing platforms have become increasingly popular in Europe over the past few years, offering investors the opportunity to earn attractive returns on their investment while providing borrowers with a convenient source of funding. With so many P2P platforms available in the market, it can be challenging to choose the right one that meets your investment goals and expectations.

In this article, we will take a closer look at the top P2P investing platforms in Europe, and help you identify the best platform that suits your investment needs. We will also discuss the key factors to consider when evaluating best P2P lending sites for investors, such as fees, platform reliability, and customer support, to ensure that you make an informed decision and maximize your investment returns.

An introduction to peer-to-peer investing platforms

P2P investing platforms have become increasingly popular over the past decade as an alternative to traditional financial institutions. These platforms allow borrowers to obtain loans and investors to invest in a variety of assets, including loans, property, and equity. Let’s explore what P2P platforms are, the types of P2P investing platforms available, and how exactly they work.

How do P2P investing platforms work?

P2P platforms are online marketplaces that bring together borrowers and investors. They allow individuals and businesses to borrow money from a group of investors who are looking to earn a return on their investment. P2P platforms offer an alternative to traditional financial institutions by providing borrowers with access to funding at a lower cost than banks, and investors with higher returns than traditional savings accounts.

P2P platforms differ from traditional lending and investing platforms in that they are not owned by banks or financial institutions. Instead, they are owned and operated by private companies that provide the platform for individuals and businesses to connect directly. In general, P2P platforms act as intermediaries, facilitating transactions between borrowers and investors, and earning a fee for their services.

P2P investing platforms typically follow a simple process. Borrowers apply for a loan, and the platform assesses their creditworthiness, typically using algorithms that consider various factors such as credit history, income, and employment status. Investors then review the borrower's profile and decide whether to invest in the loan. Once the loan is fully funded, the borrower receives the funds and makes regular repayments, which are distributed among the investors.

Types of P2P investing platforms

There are two main types of P2P investing platforms: consumer lending platforms and business funding platforms. Consumer lending platforms allow individuals to borrow money for personal expenses such as education, home improvements, or debt consolidation. Business funding platforms provide funding for small and medium-sized enterprises (SMEs) for various purposes such as business projects, working capital, inventory management, or equipment purchases.

Consumer lending platforms

Consumer lending platforms are a type of P2P platform that connects borrowers in need of personal loans with individual investors looking to lend money for interest. These platforms offer an alternative to traditional lending institutions, such as banks, which may have stricter requirements and longer approval processes.

On consumer lending Peer-to-peer platforms, borrowers can typically request a loan for a specific amount and term, and investors can choose to fund a portion or all of the loan request. Once the loan is fully funded, the borrower receives the funds and begins making repayments to the investors over the agreed-upon term. The P2P platform typically facilitates the transaction and charges fees for their services.

One of the advantages of consumer lending P2P platforms is that they may offer borrowers lower interest rates and more flexible repayment terms than traditional lenders. This can make it easier for borrowers to obtain loans, especially if they have a limited credit history or have been turned down by traditional lenders.

Investors also benefit from consumer lending P2P platforms by earning a return on their investment that may be higher than other investment options, such as savings accounts. However, as with any investment, there is also the risk of default by borrowers and potential loss of investment. Consumer lending P2P platforms have become increasingly popular in recent years, especially as more consumers and investors seek out alternative lending and investment options.

Business lending platforms

Business lending P2P platforms are designed to connect small and medium-sized enterprises (SMEs) with investors willing to fund their projects or working capital needs. These platforms have gained popularity over the years as a viable alternative to traditional bank loans, which can be difficult for small businesses to secure.

One of the main advantages of using a business lending P2P platform is the potential for faster access to funding. SMEs can submit their loan application online, and the platform's algorithm matches them with potential investors based on their creditworthiness and risk profile. This process can be much faster than traditional bank loan applications, which often involve extensive paperwork and a lengthy approval process.

Another advantage of business lending P2P platforms is the increased transparency and flexibility they offer. Unlike traditional bank loans, which often come with strict terms and conditions, SMEs can negotiate the terms of their loan directly with investors on the platform. This can include factors such as interest rates, repayment schedules, and collateral requirements.

Investors who use business lending P2P platforms also benefit from increased diversification in their investment portfolio. By investing in multiple SME loans on the platform, they can spread their risk and potentially achieve higher returns than traditional investments such as stocks or bonds. However, it's important to note that business lending platforms also come with risks. SMEs may default on their loans, causing investors to lose some or all of their investment.

Advantages of using P2P platforms

- Increased accessibility and convenience: P2P platforms offer an alternative to traditional financial institutions, making borrowing and investing more accessible to a wider range of individuals and businesses.

- Potential for higher returns on investment: P2P investing platforms offer the potential for higher returns than traditional savings accounts and other low-risk investments.

- Streamlined and automated processes: P2P platforms use automated processes for investing and borrowing, making the process faster and more efficient than traditional financial institutions.

Disadvantages of P2P investing platforms

- Risk of borrower default: there is a risk that borrowers may default on their loans, which could result in investors losing their money.

- Limited regulatory oversight: at the moment, P2P investing platforms are not subject to the same level of regulatory oversight as traditional financial institutions.

P2P investing platforms in Europe

Peer-to-peer (P2P) investing platforms have emerged as a popular alternative investment option in Europe. These platforms offer investors the opportunity to lend money for profit directly to individuals or businesses, bypassing traditional financial institutions. With the promise of higher returns and increased control over investment decisions, P2P investing has attracted a growing number of investors across Europe.

Overview of the European P2P market

The P2P market in Europe has experienced significant growth in recent years. According to a report by the European P2P lending association, the industry grew by 80% in 2019, with over €11 billion in loans issued. The United Kingdom, Germany, and France are among the largest P2P markets in Europe, with other countries such as Spain, Italy, and the Netherlands also showing significant growth potential.

Popularity of P2P investing platforms in Europe

Peer-to-peer investing platforms have gained popularity among investors due to the potential for higher returns compared to traditional investment options. These platforms offer varying levels of risk and return, with some focused on consumer loans while others cater to small business lending. Investors can choose the platform that best suits their investment goals and risk tolerance.

One of the main reasons is the low interest rate environment that has persisted in the region for several years. This has made it challenging for savers to earn a decent return on their investments, leading many to explore alternative options like P2P investing. Additionally, the rise of digital technology has made it easier for P2P platforms to operate and reach a wider audience.

Another factor contributing to the popularity of P2P investing platforms is the ability to diversify investment portfolios. P2P platforms offer a range of investment opportunities, with varying levels of risk and return, allowing investors to spread their investments across different asset classes and borrowers.

List of the best P2P platforms in Europe

Mintos

Mintos is a peer-to-peer platform that connects borrowers and investors from all over the world. It was founded in 2015 and has quickly become one of the largest P2P platforms in Europe. The platform operates in multiple countries and currencies, making it a versatile choice for investors.

Mintos offers a wide variety of loans, including personal loans, car loans, mortgage loans, and business loans. Investors can choose to invest in these loans individually or through an auto-invest feature that automatically diversifies their portfolio based on their chosen criteria.

One of the standout features of Mintos is its secondary market, which allows investors to buy and sell their investments before the loan term is up. This provides an added level of liquidity and flexibility for investors. Mintos also offers a buyback guarantee on some of its loans, meaning that if a borrower is more than 60 days late on their payments, Mintos will buy back the loan from the investor at the nominal value of the investment plus interest. This provides a level of protection for investors against borrower default.

Overall, Mintos is a well-established and reputable P2P platform with a range of loan options and features for investors. It is worth considering for those looking to diversify their investment portfolio and potentially earn higher returns than traditional investment options.

Viainvest

Viainvest is a peer-to-peer investing platform based in Latvia that connects investors with borrowers from various European countries. The platform was established in 2016 and has since then attracted a large user base due to its user-friendly interface and competitive returns. Investors can invest in loans with a minimum investment of €10 and can expect to earn returns ranging from 9% to 12% depending on the type of loan and borrower's creditworthiness.

Viainvest provides a buyback guarantee on most of its loans, which minimizes the risk of investors losing their investment in case the borrower defaults. The platform is regulated by the Financial and Capital Market Commission of Latvia and is considered to be one of the best P2P lending platforms in Europe.

Bondster

Bondster is a P2P platform that provides investors with access to loans issued by non-bank financial institutions in Europe. The platform offers loans from various loan originators in the Czech Republic, Slovakia, and other European countries. Bondster allows investors to invest in loans with low minimum investment requirements, as well as providing an Auto Invest feature.

The platform also offers a secondary market where investors can buy and sell their loans. This provides an added level of liquidity and flexibility for investors. The minimum investment amount on this platform is only €10. Overall, Bondster is a solid option for investors looking to diversify their portfolio with European P2P loans.

Robocash

Robocash is a peer-to-peer investing platform that was founded in 2017 and is based in Latvia. The platform allows investors to lend money to borrowers in various countries including Russia, Kazakhstan, Spain, and the Philippines. Robocash also offers competitive interest rates, with returns ranging from 10% to 14%. The platform charges a fee of 1% on investments, which is relatively low compared to other P2P platforms.

One of the advantages of Robocash is the ease of investing. The platform offers auto-investment options which means that investors can simply deposit funds and let the platform do the rest. The minimum investment amount is also low at just €10, making it accessible for many investors.

Another advantage is the buyback guarantee offered by Robocash. This means that if a borrower is late with their payment, the platform will buy back the loan from the investor and pay any accrued interest. This provides a level of security for investors.

However, it's important to note that the loans on the platform are unsecured, which means that there is a higher level of risk involved. Additionally, the platform is relatively new compared to other P2P platforms and has a shorter track record. Overall, Robocash is a good option for investors looking for an easy and accessible way to invest in peer-to-peer loans with competitive returns. However, investors should be aware of the risks involved and consider diversifying their portfolio across multiple P2P platforms.

Twino

Twino is a peer-to-peer investing platform that enables investors to fund personal loans in multiple European countries. The platform was founded in 2009 and has since funded over €1.2 billion in loans.

Investors on Twino can choose to invest in loans from various European countries with different interest rates and risk levels. One of the advantages of Twino is that it offers a buyback guarantee, which means that if a loan is more than 60 days overdue, Twino will buy it back from the investor. The platform also offers an auto-invest feature, which allows investors to automatically invest in loans that meet their specific criteria. The minimum investment amount is €10, and investors can withdraw their funds at any time without any penalty fees.

Overall, Twino is a reliable P2P platform with a good track record and offers features that make investing in personal loans simple and accessible. However, it's important for investors to thoroughly research and understand the risks involved with P2P lending before investing.

Peerberry

PeerBerry is a P2P investment platform based in Latvia that allows investors to invest in consumer loans. The platform mainly offers short-term consumer loans, with a typical loan term of up to 30 days. The interest rates are relatively high compared to other platforms, ranging from 9% to 13%. The platforms usually list loans from Latvia, Lithuania, Poland, Czech Republic and Denmark.

PeerBerry has an auto-invest feature, allowing investors to set their investment criteria and automatically invest in loans that match those criteria. The platform is transparent in providing details about the loan originators, including their financial statements and audited reports. The loan originators on the platform are reputable and have a proven track record. PeerBerry's user interface is easy to use, with a clean and modern design.

PeerBerry offers a buyback guarantee on all loans, meaning that if a borrower defaults on their loan, the loan originator will buy back the loan and pay any accrued interest. However, it's important to note that the buyback guarantee is provided by the loan originator and not PeerBerry, which means that it is subject to the financial stability of the loan originator.

Overall, PeerBerry is a reliable P2P investment platform that offers high-interest consumer loans and provides a user-friendly experience for investors. Platform doesn't charge any fees to investors. Instead, the loan originators on the platform pay a commission to PeerBerry for providing them access to investors.

Kviku Finance

Kviku is a European peer-to-peer platform that specializes in short-term loans. Founded in 2017, the platform is based in Estonia and operates in several European countries, including Lithuania, Spain, and Russia. The Kviku platform is easy to use, with a simple and intuitive interface. Investors can start investing with just €10, and the platform offers competitive interest rates on their short-term loans.

Investors on the Kviku platform can invest in short-term consumer loans, with investment terms ranging from 30 to 90 days. The platform offers a buyback guarantee on all loans, which means that if a borrower defaults on their loan, Kviku will buy back the loan from the investor. Kviku also provides a secondary market where investors can sell their investments to other investors, providing liquidity and flexibility to the platform's investors.

Overall, Kviku is a solid option for investors looking for a peer-to-peer platform that specializes in short-term loans. With its user-friendly interface, competitive interest rates, and buyback guarantee, Kviku offers a reliable and transparent investment opportunity.

Debitum Network

Debitum Network is a Latvian-based P2P platform that connects small and medium-sized businesses with investors. The platform was launched in 2018 and has since then facilitated loans worth millions of euros. Debitum Network stands out from other P2P platforms as it replaces traditional banks and other financial institutions, making it easier for SMEs to secure funding.

Investors on the platform can choose from various types of loans, including short-term, invoice financing, and asset-backed loans. The minimum investment is €10, and the interest rates range from 8% to 11%. Debitum Network also offers investors a buyback guarantee, which means that the platform will buy back any outstanding loan at the principal amount plus accrued interest if the loan is overdue by more than 90 days.

Overall, Debitum Network is a reliable platform that offers investors the opportunity to invest in SME loans while also providing a secure and transparent environment for businesses to obtain funding.

Lendermarket

Lendermarket is a P2P investment platform that provides investors with an opportunity to invest in short-term loans. The platform is a part of Creditstar Group, a leading consumer finance provider in Europe. Lendermarket is formally headquartered in Ireland, however main business operations are primarily ongoing in Estonia.

Investors on Lendermarket can invest in loans originated by Creditstar Group, which are typically unsecured loans with a maturity of up to 60 days. The loans are issued to borrowers in Spain, Poland, and the Czech Republic. Lendermarket offers a buyback guarantee on all loans, which means that if a loan is delayed by more than 60 days, the borrower’s obligation is bought back by Creditstar Group at the principal amount plus accrued interest.

Lendermarket offers a simple and user-friendly platform, with a minimum investment of just €10. The platform also offers an auto-invest feature that allows investors to automatically invest in loans that match their investment criteria. The interest rates on loans range from 12% to 14%, depending on the loan term and risk level. Overall, Lendermarket is a solid option for investors looking to invest in short-term loans with a buyback guarantee. The platform offers a simple and user-friendly interface, with competitive interest rates and no fees to investors.

GoParity

GoParity is a Portuguese peer-to-peer investing platform that specializes in impact investing. The platform offers its investors a variety of investment opportunities focused on supporting sustainable and social projects. Founded in 2018, the platform aims to democratize the investment process and enable anyone to invest in impactful projects.

GoParity offers two types of investments: loans and equity. Investors can choose to invest in either one, depending on their risk appetite and investment goals. Loans typically offer lower returns but are less risky, while equity investments can offer higher returns but are riskier. One of the unique aspects of GoParity is its focus on sustainability. The platform only works with projects that align with the United Nations' Sustainable Development Goals. This means that investors can feel confident that their investments are making a positive impact on the environment or society.

Overall, GoParity is an excellent choice for investors who are passionate about impact investing and want to support sustainable and social projects. The platform's focus on sustainability and impact sets it apart from other P2P platforms, making it an attractive option for socially responsible investors.

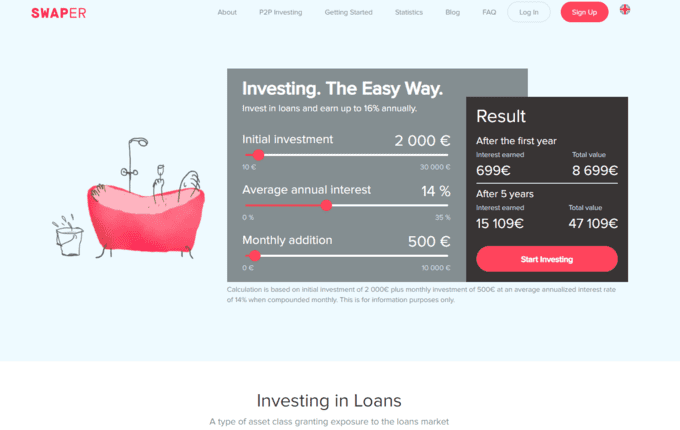

Swaper

Swaper is a peer-to-peer platform that allows investors to invest in consumer loans. The platform was launched in 2016 and has its headquarters in Latvia. Swaper offers only one investment type, which is investing in consumer loans. The loans are pre-funded by the platform and investors can choose to invest in individual loans or auto-invest in loans that match their investment criteria.

The returns on Swaper vary depending on the loan term and amount invested. The average return on the platform is around 12%, and investors can earn up to 14% on certain loans. Swaper offers an auto-invest feature that allows investors to automatically invest in loans that match their investment criteria. Investors can set the investment amount, loan term, and interest rate, and the platform will automatically invest in loans that meet those criteria.

Platform also offers a secondary market where investors can sell their loans to other investors. The platform charges a fee of 2% of the loan value for selling loans on the secondary market. Swaper also offers a buyback guarantee on loans that are more than 30 days overdue. The platform will buy back the loan from the investor at the nominal value of the loan plus accrued interest.

Overall, Swaper is a simple and user-friendly P2P platform that offers solid returns on investments. The auto-invest feature and secondary market make it easy for investors to manage their portfolios, while the buyback guarantee provides an extra layer of security.

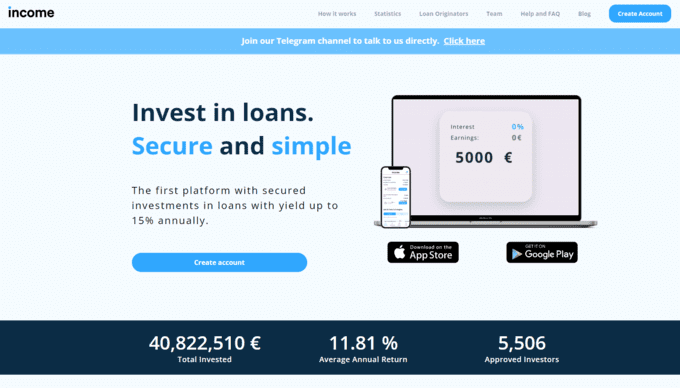

Income Marketplace

Income Marketplace is a peer-to-peer platform based in Estonia that offers loans to small and medium-sized enterprises (SMEs). The platform was founded in 2017 and is regulated by the Estonian Financial Supervision Authority. Investors can choose from a range of loans with varying interest rates and maturities, and the minimum investment is €10. Income Marketplace also offers a secondary market where investors can sell their loans to other investors.

One unique feature of Income Marketplace is its "Buyback Fund", which is a reserve fund that helps protect investors from losses due to borrower defaults. If a borrower defaults on a loan, the Buyback Fund will cover the principal and accrued interest owed to investors. Income Marketplace charges investors a 1% service fee on the outstanding loan balance, and borrowers are charged an origination fee of 2-6% depending on the loan type and term.

Overall, Income Marketplace seems to be a solid P2P platform for investors interested in SME lending, with a focus on risk mitigation through its Buyback Fund. However, as with any investment, there are risks involved, and investors should carefully consider their options before investing

Bondora

Bondora is a P2P platform that was founded in Estonia in 2009. It is one of the most established platforms in Europe. Bondora offers loans from Estonia, Finland, and Spain, and investors can invest in these loans with a minimum investment of just €1. Bondora's loan portfolio includes personal loans, car loans, and small business loans. Investors can choose to invest manually or use Bondora's auto-invest feature, which automatically invests their funds based on their selected criteria.

One of the unique features of Bondora is its "Portfolio Pro" tool, which allows investors to create custom portfolios with specific criteria, such as loan type, borrower rating, and loan duration. Bondora also offers a secondary market, where investors can sell their investments before the end of the loan term. However, it's worth noting that this market can be illiquid and it may be difficult to sell investments quickly.

Overall, Bondora is a reliable platform with a long track record of success. Its auto-invest feature and custom portfolio tool make it easy for investors to diversify their investments, and the ability to invest in loans with just €1 is a major advantage. However, the secondary market may not be suitable for all investors.

Savy

Savy is a peer-to-peer platform that operates in Lithuania. Established in 2014 the platform connects borrowers with investors and allows investors to earn returns by money lending. Savy offers a range of loans, including personal loans, car loans, and business loans. The platform has a user-friendly interface, which allows investors to track their investments on-the-go.

Savy also offers a buyback guarantee, which reduces the risk of investment by ensuring that investors will receive their principal investment back if the borrower defaults on the loan. The minimum investment amount is €10, and investors can expect to earn returns of up to 12%. Overall, Savy appears to be a reliable and transparent platform for investors who are looking to invest in the Lithuanian peer-to-peer market.

Paskolų klubas

Paskolų klubas is a P2P investing platform based in Lithuania that allows investors to invest in loans issued to borrowers by the platform. The platform offers loans to individuals and businesses with different credit ratings and loan terms. The minimum investment amount is €20, and investors can expect to earn returns of up to 12%.

Paskolų klubas offers a buyback guarantee to investors, which means that if a borrower defaults on their loan, the platform will buy back the loan from the investor. Overall, Paskolų klubas is a reliable and transparent P2P investing platform that provides good returns and a buyback guarantee to investors.

Finbee

Finbee is a peer-to-peer investing platform that was launched in Lithuania in 2015. The platform provides investors with the opportunity to invest in loans issued to both individuals and businesses. It offers a range of loans, including consumer loans, business loans, and invoice financing. The minimum investment on the platform is only €5, and investors can earn returns of up to 14%.

Finbee offers a secondary market where investors can sell their loan parts to other investors, providing greater liquidity. The platform also has an automatic investment feature that allows investors to invest automatically according to pre-defined criteria. Overall, Finbee is a solid platform for investors looking to diversify their portfolio with peer-to-peer loans in Lithuania.

Factors to consider when choosing a P2P platform

Peer-to-peer (P2P) platforms have become a popular alternative investment option for many individuals seeking higher returns than traditional savings accounts or bonds. With P2P lending, borrowers can access affordable loans while investors can earn attractive returns on their investments. However, the quality and reliability of P2P platforms can vary widely, making it crucial for investors to find the best platform for their needs. With so many P2P platforms available, it can be challenging to choose the right one. However, here are some key factors to consider when choosing a P2P platform:

- Platform reputation and credibility: the reputation and credibility of a P2P investing platform are crucial factors to consider when choosing a platform. It is essential to conduct thorough research and read reviews and feedback from other investors to gauge their experience with the platform. Look for a platform that has a good track record and positive reviews from investors.

- Platform performance: consider the P2P platform's performance history, including its loan default rate, return on investment, and how long it has been operating. A platform with a low default rate and a good ROI record is a good indicator of a well-managed platform that is likely to provide positive returns.

- Diversification options: a good P2P platform should offer a wide range of investment options that can help you diversify your portfolio. Look for platforms that offer different types of loans, such as consumer loans, business loans, or real estate loans, across multiple sectors and geographies.

- Platform fees: Different P2P investing platforms have different fee structures, which can significantly impact your returns. It is essential to consider the fees charged by the platform, including origination fees, servicing fees, and early exit fees, and evaluate how they impact your investment returns.

- Security and risk management: consider how the platform manages risk and secures your investments. Look for platforms that have established risk management policies and security protocols, such as insurance policies, that can protect your investments against borrower default and other risks.

- Transparency and accessibility: a transparent platform provides investors with comprehensive and up-to-date information about their investments, including performance metrics, loan originators' profiles, and borrower information. Choose a platform that is transparent and accessible, with a user-friendly interface that makes it easy to navigate and invest.

Selecting the right P2P platform requires careful consideration of multiple factors. A well-established platform with a good reputation, strong performance history, diverse investment options, and transparent fee structures can help investors earn a higher return on their investment while minimizing risk. By evaluating these factors, investors can choose the P2P platform that aligns with their investment goals and risk tolerance.

Final thoughts on choosing the best P2P platform in Europe

In conclusion, choosing the best P2P platform in Europe requires careful consideration of various factors such as the platform's track record, transparency, loan diversification, fees and charges, and user experience. It is also important to conduct thorough research and due diligence before making any investment decisions.

Investors should keep in mind that P2P investing comes with risks such as borrower default and the lack of guaranteed returns. Therefore, it is essential to diversify investments across different loans and platforms to reduce risk.

Overall, the P2P market in Europe is rapidly growing and offers investors the opportunity to earn higher returns than traditional investments. By choosing the right Peer-to-peer investing platform, investors can access a range of investment options and participate in a new era of financial innovation.