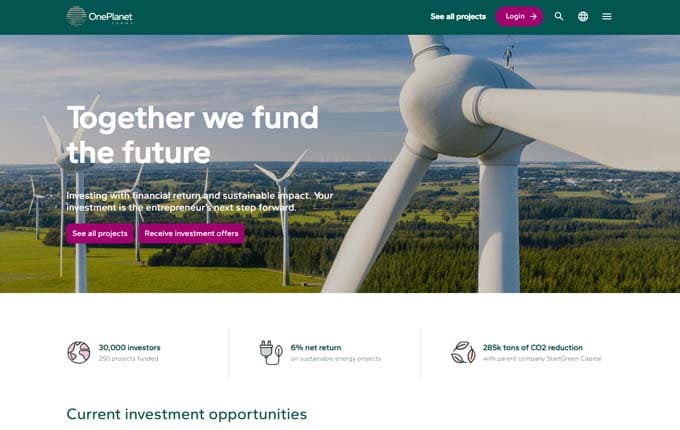

Oneplanetcrowd

Together we fund the future.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

8.00 %Min. investment

250 €Oneplanetcrowd platform review.

Oneplanetcrowd is the leading sustainable crowdfunding platform in the Netherlands, offering a unique opportunity for forward-thinking investors to directly invest in social and sustainable companies. By investing through Oneplanetcrowd, you not only have the potential to earn attractive returns but also contribute to making a positive impact on both people and the environment. In this article, we will provide you with a comprehensive overview of Oneplanetcrowd, addressing important questions to assist you in getting started on this platform.

What is Oneplanetcrowd?

Oneplanetcrowd is a crowdfunding platform that was founded in 2012. It provides a platform where forward-thinking investors can lend money to social and innovative companies. The unique aspect of Oneplanetcrowd is that it offers not only an attractive financial return but also a positive impact on people and the environment. By investing through Oneplanetcrowd, you have the opportunity to contribute to the transition towards a sustainable economy.

Oneplanetcrowd aims to tackle the challenges we face by bringing together innovative companies and future-oriented investors. The platform serves as a meeting point where these two groups collaborate to accelerate the transition towards a sustainable economy. The mission of Oneplanetcrowd is to create a double return for investors: a financial return and a positive impact on society and the environment.

By connecting investors with social-innovative companies, Oneplanetcrowd strives to support the growth of sustainable businesses and address the pressing issues of our time. Together with companies and investors, Oneplanetcrowd works towards building a more sustainable future.

Types of investments available on Oneplanetcrowd

Oneplanetcrowd offers two types of investments, each with its own characteristics in terms of return and risk:

- Loan: with a loan investment, you provide funds to a company that has already generated revenue and is looking to take the next step in its growth, or to a sustainable energy project with relatively predictable cash flows. The company is expected to generate sufficient cash flow during the loan term to repay the loan along with interest. The interest rate for loan investments generally falls within the range of 4% to 10%. The loan term typically ranges from 1 year to 10 years. Repayment options for loans include linear, bullet, or annuity structures.

- Convertible loan: a convertible loan offers investors the opportunity to potentially become shareholders of a company in the future. This type of investment is often provided to young and innovative companies that have the potential for rapid growth. These companies may have limited revenue at present, making future cash flows less predictable. However, the expected return on investment with a convertible loan can be significantly higher than that of regular loans.

By offering these two investment options, Oneplanetcrowd caters to different types of investors and provides opportunities to support both established companies and promising startups in the sustainable and social impact space.

Investing with Oneplanetcrowd

To start investing on Oneplanetcrowd, investors are required to create an account and complete the necessary verification process by uploading the required personal documents for identity verification. As part of this process, Oneplanetcrowd will request a copy of your passport or another government-issued identification document. Once your account is verified, you can transfer the desired investment amount using direct iDeal payment, a bank transfer, or payment through Bancontact.

Oneplanetcrowd has certain criteria that investors must meet. Private investors should have a bank account with a bank in the SEPA area, be at least 18 years old, and be a resident of the SEPA area or the Caribbean Netherlands. For business customers, the company must be a Dutch legal entity and registered in the Netherlands.

Investors have the option to make payments using iDEAL and Bancontact. For investments of 500 euros and above, bank transfers are also accepted. Only direct bank transfers from an IBAN account in a SEPA country are permitted. Throughout the campaign, all payments are securely processed through a third-party account held by Oneplanetcrowd's independent payment partner, Buckaroo.

Risk and returns

Investing in crowdfunding carries risks similar to investing in private companies. There is a possibility that a company may be unable to fulfill its loan or convertible loan obligations, which could result in partial or total loss of the investment.

Oneplanetcrowd endeavors to feature responsible and promising projects and companies on its platform. However, Oneplanetcrowd does not provide a guarantee that a company will meet its obligations. Following the campaign, Oneplanetcrowd ensures, on behalf of the investors, that the company adheres to its obligations in accordance with the loan agreement's terms and conditions.

Crowdfunding can be a valuable addition to an investment portfolio as it often offers higher financial returns compared to saving or investing in the stock market. It is crucial for investors to determine the portion of their assets suitable for crowdfunding and the types of projects they wish to invest in. Diversification is also advisable, meaning spreading investments across different projects to mitigate investment risk. Oneplanetcrowd recommends investing no more than 10% of investable capital in crowdfunding projects and diversifying the overall investment by allocating it to a minimum of 10 projects.

Investors fees on Oneplanetcrowd

Investors are required to pay a servicing fee to Oneplanetcrowd for the services provided. The servicing fee, typically 0.8%, is deducted from the periodic interest payments and repayments made by the enterprises to the investors. Once a convertible loan is converted into depository receipts of shares, the servicing fee is no longer applicable.

For example, let's consider a loan or bond of €1000 with a duration of 4 years and equal quarterly repayments. In this scenario, the total servicing fee amounts to €17.03 when the fee is set at 0.8%.

Oneplanetcrowd overview

To summarize, Oneplanetcrowd is a prominent crowdfunding platform focused on sustainability, where forward-thinking investors provide financial support to socially innovative companies. Oneplanetcrowd aims to deliver a twofold return on investments: a positive financial return alongside a significant social impact. By promoting this dual benefit, Oneplanetcrowd endeavors to expedite the transition toward a sustainable economy.

Oneplanetcrowd summary

Advantages:

- Social and environmental impact: Oneplanetcrowd offers an excellent opportunity for average investors to contribute to positive social and environmental change.

Points to consider:

- High-risk investment: it's crucial to acknowledge that investing in startups involves inherent risks that investors should be aware of.

- Investor fees: investors should take into account the periodic fee (approximately 0.8%) charged for the services provided by Oneplanetcrowd.