Max Crowdfund

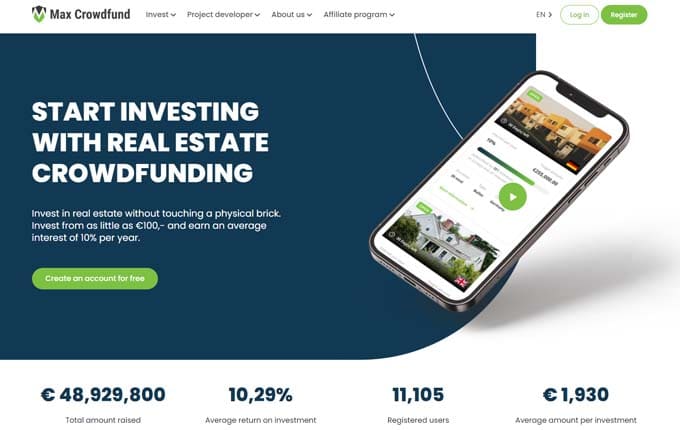

Start investing with real estate crowdfunding.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

10.00 %Min. investment

100 €Max Crowdfund platform review.

Max Crowdfund is a Netherlands-based real estate crowdfunding platform that facilitates online investments in real estate starting from €100. The platform allows real estate developers to secure funding directly from investors. All investments on Max Crowdfund are denominated in EUR. The platform is operated by Max Crowdfund BV, a company established in 2019 with its headquarters located in Rotterdam, Netherlands.

Investment options and returns on Max Crowdfund

Max Crowdfund, a rapidly growing crowdfunding platform, is a subsidiary of Max Property Group, a multinational real estate investment firm headquartered in Rotterdam, the Netherlands. With over 11,000 investors, Max Crowdfund offers a diverse range of real estate projects from multiple European countries, including Germany, the Netherlands, Belgium, and the UK. This unique offering allows investors to diversify their investment portfolios within the real estate crowdfunding space.

The platform primarily focuses on financing development projects for new properties or renovations of existing properties. Investors can expect to receive their invested capital along with interest during the project's specified term, typically ranging from 18 to 24 months. Max Crowdfund has achieved an average annual return of 10%, making it an attractive option for investors seeking competitive returns in the real estate sector.

Investing on the Max Crowdfund platform

Getting started with Max Crowdfund and generating income on the platform is a straightforward process. The first step is to create a verified account, which will grant you access to a personalized dashboard where you can find comprehensive information about investment opportunities. Your dashboard will display your profile, account balance, and support resources.

All loans listed on Max Crowdfund undergo thorough analysis and approval by real estate experts. Once your account registration is complete, you'll have access to detailed investment information, including interest rates, project locations, loan durations, and investment risks. This enables you to make well-informed investment decisions.

To begin investing, simply deposit a minimum of €100 into your account. Once you've invested in a loan and it reaches its target fundraise, the investment window will close. You'll then start receiving interest payments according to the loan schedule. The interest earned can be reinvested in other loans on Max Crowdfund or transferred to your bank account. Upon project completion, you can expect to receive the appropriate capital repayment.

Max Crowdfund makes the investment process convenient and transparent, allowing you to easily track and manage your investments while generating income on the platform.

Is Max Crowdfund regulated?

Max Crowdfund operates under the regulation of the Dutch Financial Authorities and holds the distinction of being the first platform of its kind to receive approval from the Authority for the Financial Markets (AFM). In addition, Max Crowdfund is fully compliant with the new European Union Crowdfunding Regulations that came into effect in November 2021. These regulatory measures ensure that the platform adheres to established standards and safeguards.

However, it's important to note that while Max Crowdfund operates within the regulatory framework, your investment is not covered by any government or other type of investment compensation scheme. This means that investing with Max Crowdfund carries inherent risks, and you should carefully assess and manage these risks before making any investment decisions.

Max Crowdfund fees

Max Crowdfund implements a monthly administration fee of 0.1% based on the outstanding investments of its users. For instance, if you invest €100, you would be charged a monthly administration fee of €0.10. It's crucial to take into account these platform fees as they impact the interest earned by investors. Evaluating the fees in relation to potential earnings is essential when making investment decisions.

To incentivize investors, Max Crowdfund offers a loyalty program that rewards them based on the number of investment opportunities they participate in. This loyalty scheme does not increase the investment returns directly but provides a discount on the monthly administration fee. Active and larger-scale investors can benefit from the Max Crowdfund loyalty program, potentially saving up to 50% on fees.

Max Crowdfund secondary market

Max Crowdfund platform does not provide a secondary market where investors can buy or sell loans among themselves. Although the absence of a secondary market limits liquidity and the ability to trade investments, it is important to acknowledge the platform's emphasis on offering carefully selected investment opportunities in the primary market. Investors can still explore a variety of projects and directly invest in the initial issuance, allowing them to benefit from the potential returns and income generated by those investments. While the lack of a secondary market may restrict trading flexibility, investors can focus on the primary market's curated opportunities and the long-term potential they offer.

Possible risks when investing on Max Crowdfund

Each project on Max Crowdfund is unique, with varying conditions, terms, and interest rates. This diversity ensures that the risks associated with each loan differ as well. To provide comprehensive information about these risks, each loan is categorized into a specific risk class. Furthermore, details such as loan-to-value (LTV) ratio, total loan value, additional loan information, and various loan agreements are always provided when a new loan is listed. This transparency enables investors to make well-informed decisions.

In addition to transparency, Max Crowdfund offers an extra layer of security. In most cases, Max Crowdfund holds the first mortgage right. This means that in the event of default, Max Crowdfund has the priority to sell the underlying property and use the proceeds to repay investors. Consequently, even in unexpected bankruptcy situations, Max Crowdfund has a higher priority than entities like tax authorities or banks. This added security helps protect the interests of investors on the platform.

Max Crowdfund summary

Max Crowdfund is a prominent international real estate crowdfunding platform that has gained popularity among investors. With an average annual return of approximately 10%, it offers a competitive investment opportunity. While the returns may be slightly lower compared to P2P lending platforms, the platform's focus on lower risk investments is reassuring.

The platform operates under the regulations and oversight of Dutch financial authorities, ensuring compliance and investor protection. Additionally, a significant portion of the loans on Max Crowdfund are backed by first mortgage rights, adding an extra layer of security. The platform benefits from a knowledgeable team with expertise in the real estate sector, instilling confidence in the investment process.

However, it's important to consider some drawbacks of Max Crowdfund. The fee structure includes a monthly charge of 0.1%, which can impact the overall returns for investors. Furthermore, the absence of a secondary market and the lack of an auto-investing option limit liquidity and automation in the investment process.

In summary, Max Crowdfund offers a solid option for real estate investments, considering its regulated operations, lower risk profile, and knowledgeable team. However, it's important to carefully evaluate the fee structure and consider the limitations in terms of liquidity and automation.

Max Crowdfund overview

Advantages:

- Majority of the projects on the platform are backed by first-line mortgages, providing an added layer of security.

- The platform allows you to start investing with as little as 100 euros, making it accessible to a wide range of investors.

Points to consider:

- There is a 0.1% monthly administration fee charged by the platform, which should be taken into account when calculating potential returns.

- Max Crowdfund does not offer a secondary market, limiting the ability to buy or sell loans among investors.

- The platform does not provide an auto-investing feature, which means you have to manually select and manage your investments.