Real estate crowdfunding platforms in Europe: an overview and comparison

Are you looking for real estate crowdfunding platforms in Europe? Delve into the world of crowdfunding platforms for real estate and find the best options available. Our all-inclusive guide covers the top European real estate crowdfunding platforms and provides valuable insights into the factors you should consider when selecting the right one for your investment needs.

Real estate has long been considered one of the safest and most reliable investment options. However, investing in real estate often requires significant capital, which can be a barrier for individual investors. This is where real estate crowdfunding platforms come in, providing a way for individuals to invest in real estate projects with smaller amounts of money.

In this article, we will provide a comprehensive guide to the best real estate crowdfunding platforms in Europe. We will cover the definition of real estate crowdfunding platforms, the benefits of investing in them, and the different types of platforms available. We will also provide a list of the top real estate crowdfunding platforms in Europe, including detailed descriptions. By the end of this article, you will have a clear understanding of the real estate crowdfunding landscape in Europe and be able to make informed decisions when choosing the best crowdfunding platform for the best real estate investments.

Real estate crowdfunding platforms: an overview

Real estate crowdfunding platforms have revolutionized the way people invest in real estate, opening up investment opportunities that were once only available to institutional investors and high net worth individuals. These online investment platforms allow investors to pool their money together to invest in a wide range of real estate projects, from commercial properties to residential developments.

Crowdfunding platforms for real estate - how do they work?

Real estate crowdfunding platforms are online investment platforms that allow individuals to invest in a real estate project. Basically, with the help of real estate crowdfunding platforms, people can access a wider range of investment opportunities and invest in real estate projects with smaller investment amounts.

In general, crowdfunding platforms for real estate operate on the principle of crowdfunding, where a large number of people pool their money together to invest in a project. This pooling of resources allows individual investors to invest in real estate projects that they would not have been able to invest in on their own due to high investment requirements. So, the real estate crowdfunding platform acts as an intermediary between investors and real estate developers, providing an infrastructure for investors to invest their money and for developers to raise capital for their projects.

Real estate crowdfunding platforms typically provide investors with detailed information about the real estate investment opportunities, such as the location, the type of property, the expected return on investment, and the investment amount required. Investors can then decide whether to invest in the project based on their investment goals.

Types of real estate crowdfunding platforms

Real estate crowdfunding platforms come in different types, each with its own unique features and investment opportunities. The three main types of real estate crowdfunding platforms are debt-based, equity-based, and hybrid crowdfunding.

- Debt-based crowdfunding. Debt-based crowdfunding, also known as peer-to-peer lending, involves investors providing loans to real estate developers. The real estate developer borrows the funds and pays interest to the investors over a set period of time. Debt-based crowdfunding platforms typically offer lower risk investments with lower returns compared to other types of crowdfunding platforms. Investors receive fixed interest payments, and their principal usually is returned at the end of the loan term.

- Equity-based crowdfunding: Equity-based crowdfunding platforms involve investors buying a stake in a real estate project in exchange for equity. Investors own a share of the property and receive a portion of the rental income and profits when the property is sold. Equity-based crowdfunding platforms typically offer higher returns compared to debt-based crowdfunding platforms, but also come with slightly higher risks.

- Hybrid crowdfunding: Hybrid crowdfunding platforms combine debt and equity-based crowdfunding, providing investors with the opportunity to invest in both debt and equity instruments. Investors can choose to invest in the debt or equity portion of the project, depending on their investment goals and risk tolerance.

In addition to these three main types, there are also real estate crowdfunding platforms that specialize in specific types of real estate projects, such as commercial properties or residential developments. These platforms may offer more targeted investment opportunities for investors interested in a specific type of real estate project. Choosing the right type of real estate crowdfunding platform depends on an investor's investment goals, risk tolerance, and level of experience.

Advantages of using real estate crowdfunding platforms

Real estate crowdfunding platforms have revolutionized the way usual individuals can participate in the real estate market. These platforms offer a range of advantages that have made investing in real estate more accessible, transparent, and potentially profitable. Let’s explore the key advantages of using real estate crowdfunding platforms and how they can benefit investors looking to diversify their portfolios and generate passive income:

- Accessibility: real estate crowdfunding platforms make investing in real estate accessible to a wider range of investors. Individuals with smaller amounts of capital can pool their funds with other investors to invest in larger real estate projects that they may not have been able to invest in on their own.

- Diversification: real estate crowdfunding platforms allow investors to diversify their portfolios by investing in multiple real estate projects with smaller amounts of capital. This diversification can help reduce risk and potentially increase returns.

- Transparency: top real estate investing platforms provide investors with transparency and access to information about projects being developed, including financial reports and project updates. This level of transparency can help investors make informed investment decisions.

- Passive income: investing in real estate crowdfunding platforms can provide investors with a passive income stream through rental income and profits from the sale of the property.

Disadvantages of using real estate crowdfunding platforms

Real estate crowdfunding platforms offer investors an accessible and potentially profitable way to invest in real estate projects. However, it is important for investors to carefully consider the risks and drawbacks of investing in these platforms before committing their funds:

- Risk: investing in real estate crowdfunding platforms comes with inherent risks, including the risk of project failure or delays, market fluctuations, and the potential for fraud.

- Illiquidity: real estate investments are typically illiquid, meaning that they cannot be easily sold or converted to cash. Investors in real estate crowdfunding platforms may not be able to access their funds until the end of the investment term.

- Fees: real estate crowdfunding platforms often charge fees for their services, including management fees, performance fees, and administrative fees. These fees can eat into investor returns and reduce overall profitability.

- Limited control: investors in real estate crowdfunding platforms typically have limited control over the real estate project and are reliant on the platform to manage the investment.

Real estate crowdfunding platforms in Europe

Real estate crowdfunding platforms have gained significant popularity in recent years, providing investors with an accessible and potentially profitable way to invest in the real estate market. In Europe, the market for real estate crowdfunding platforms has seen substantial growth, with a range of platforms offering diverse investment opportunities. Let’s explore the reasons behind the popularity of real estate crowdfunding platforms in Europe.

Overview of the European real estate crowdfunding market

The European real estate crowdfunding market has grown substantially in recent years, with a range of platforms offering investors access to real estate investment opportunities. According to a report by KPMG, the European real estate crowdfunding market is expected to grow from €4.2 billion in 2018 to €18.4 billion by 2023. The growth of the market has been fueled by factors such as the low-interest-rate environment, the search for alternative investments, and the increasing popularity of technology-enabled investing.

Real estate crowdfunding platforms in Europe have seen significant growth in recent years, offering investors an accessible and potentially profitable way to invest in the real estate market. With a range of platforms available and diverse investment opportunities on offer, real estate crowdfunding is becoming an increasingly popular choice for investors looking to diversify their portfolios and generate passive income. By conducting thorough research and due diligence, investors can potentially benefit from the advantages of real estate crowdfunding platforms while minimizing the associated risks.

Popularity of real estate crowdfunding platforms in Europe

Real estate crowdfunding platforms have become increasingly popular in Europe due to their accessibility and potential for high returns. These platforms allow investors to pool their funds and invest in a range of real estate projects, from residential and commercial properties to development projects and renovations. Real estate crowdfunding platforms in Europe also offer investors the opportunity to diversify their portfolios, with a range of investment options available at varying levels of risk and return.

In addition to these benefits, real estate crowdfunding platforms in Europe also offer transparency and access to information about the projects, enabling investors to make informed investment decisions. The platforms also offer a range of services, such as due diligence, property management, and legal support, to help investors manage their investments effectively.

List of real estate crowdfunding platforms in Europe

Here are some of the most popular crowdfunding platforms for real estate in Europe:

Reinvest24

Reinvest24 is a real estate crowdfunding platform that provides investors with an opportunity to invest in a variety of real estate projects with relatively low minimum investment requirements. The platform was founded in 2017 and is based in Tallinn, Estonia.

The platform offers a range of investment opportunities, including residential and commercial real estate projects, as well as rental properties. Reinvest24's due diligence process includes a thorough review of the project's financials, the developer's track record, and an analysis of the local real estate market. Investors can invest in projects on the platform for as little as 100 euro, and the platform offers competitive fees compared to other crowdfunding platforms. Reinvest24 also provides a user-friendly platform with detailed information about each project, including photos, financial projections, and project timelines.

One unique feature of Reinvest24 is the ability to invest in rental properties, which can provide investors with a steady stream of rental income. The platform also provides investors with the opportunity to exit their investments before the project is completed through a secondary market.

Overall, Reinvest24 appears to be a reputable real estate crowdfunding platform that offers a variety of investment opportunities with relatively low minimum investment requirements. The platform provides a user-friendly interface, transparency, and a thorough due diligence process. Investors seeking to diversify their investment portfolios with real estate crowdfunding may find Reinvest24 to be a suitable option.

Estateguru

Estateguru is a peer-to-peer lending platform that specializes in real estate-backed loans. The platform was founded in Estonia in 2013 and has since expanded to several other European countries, including Finland, Latvia, Lithuania, and Spain.

Estateguru's platform provides investors with the opportunity to invest in a range of real estate-backed loans, including bridge loans, development loans, and buy-to-let loans. The platform offers competitive interest rates, ranging from 8% to 12%, depending on the loan and the borrower's creditworthiness. Investors can invest in loans on the Estateguru platform with as little as 50 euro, making it accessible to a wide range of investors. The platform also provides a secondary market where investors can buy and sell their investments before the loan term ends.

The platform's due diligence process is comprehensive and includes a review of the borrower's credit history, the property's value and condition, and an analysis of the local real estate market. Estateguru also provides investors with detailed information about each loan, including the loan amount, interest rate, loan term, and the loan-to-value ratio.

Overall, Estateguru appears to be a reputable peer-to-peer lending platform that provides investors with an opportunity to invest in real estate-backed loans with competitive interest rates. The platform's due diligence process is thorough, and the platform provides detailed information about each loan. While the lack of an investor protection fund may be a concern for some investors, the buyback guarantee on some loans provides added security.

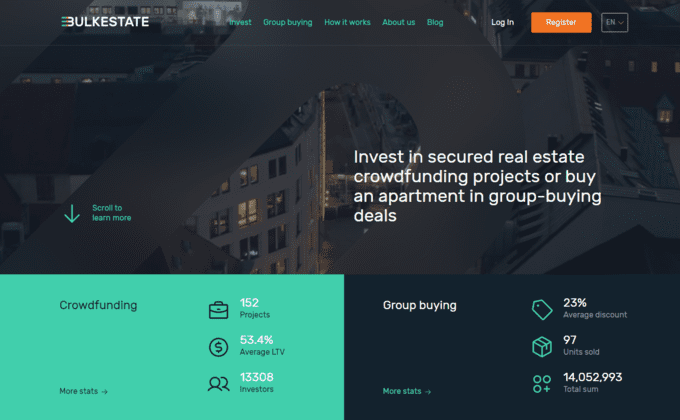

Bulkestate

Bulkestate is a real estate crowdfunding platform that provides investors with an opportunity to invest in a range of real estate projects in Latvia and Estonia. The platform was founded in 2016. Bulkestate offers a variety of investment opportunities, including development projects, renovation projects, and rental properties. The platform's due diligence process is thorough and includes an analysis of the borrower's financials, the property's value and condition, and an assessment of the local real estate market.

Investors can invest in projects on the platform for as little as 50 euros, and the platform offers competitive interest rates, ranging from 10% to 14%, depending on the project and the borrower's creditworthiness. Bulkestate also provides a user-friendly platform with detailed information about each project, including photos, financial projections, and project timelines.

One unique feature of Bulkestate is the ability to invest in short-term loans, which can provide investors with quicker returns on their investment. The platform also provides investors with the opportunity to exit their investments before the project is completed through a secondary market.

Overall, Bulkestate appears to be a reputable real estate crowdfunding platform that offers a range of investment opportunities with relatively low minimum investment requirements. The platform's due diligence process is comprehensive, and the platform provides a user-friendly interface with detailed information about each project. Investors seeking to diversify their investment portfolios with real estate crowdfunding may find Bulkestate to be a suitable option.

Brickstarter

Brickstarter is a real estate crowdfunding platform launched in 2019, that allows investors to invest in properties located in Spain Brickstarter offers investors the opportunity to invest in a range of real estate projects, including residential properties, commercial properties, and development projects.

Investors can invest in projects on the platform for as little as 500 euros, and the platform offers competitive interest rates, ranging from 7% to 10%, depending on the project and the borrower's creditworthiness. Brickstarter also provides investors with a user-friendly platform with detailed information about each project, including photos, financial projections, and project timelines.

Overall, Brickstarter appears to be a reputable real estate crowdfunding platform that offers investors a range of investment opportunities with relatively low minimum investment requirements. The platform's due diligence process is thorough, and the platform provides a user-friendly interface with detailed information about each project. Investors seeking to diversify their investment portfolios with real estate crowdfunding in Spain may find Brickstarter to be a suitable option.

Profitus

Profitus is a crowdfunding platform based in Lithuania that offers a variety of investment opportunities. The platform provides investors with the ability to invest in real estate projects and real estate-backed business loans.

One of the key features of Profitus is its focus on real estate investments. The platform offers investors the opportunity to invest in a variety of real estate projects, including residential and commercial properties. These investments can provide attractive returns for investors, with projected annual returns ranging from 6% to 12%.

The platform is regulated by the Bank of Lithuania and operates in accordance with European Union regulations. Investors can start investing on Profitus with a minimum investment of 100 euros, and there are no fees for investors to pay. However, Profitus does charge a service fee to borrowers.

Overall, Profitus is a solid real estate crowdfunding platform that offers investors a variety of investment opportunities with attractive returns. The platform's focus on real estate investments make it a compelling option for investors looking to diversify their portfolio.

Lend7

Lend7 is a platform that leverages blockchain technology to provide investors with the opportunity to invest in real estate assets. The platform aims to revolutionize the traditional real estate market by tokenizing properties and making them accessible to a wider range of investors.

One of the key features of Lend7 is its use of non-fungible tokens (NFTs) to represent ownership of real estate assets. This allows investors to own a fraction of a property, rather than having to invest in the entire property. NFTs also provide a high degree of transparency and security, as ownership is recorded on the blockchain and cannot be tampered with.

The platform offers a variety of investment opportunities, including residential and commercial properties. Investors can choose to invest in properties located in different countries and can diversify their portfolio by investing in multiple properties. Lend7 also provides investors with the ability to earn rental income from their investments. This is a unique feature of the platform, as traditional real estate investments typically require a large upfront investment and are often illiquid.

Overall, Lend7 is a promising platform that has the potential to disrupt the traditional real estate market. Its use of NFTs provides a high degree of transparency and security, while its focus on fractional ownership and rental income make it an attractive option for investors. As the platform continues to develop and expand, it will be interesting to see how it evolves and impacts the real estate industry.

Letsinvest

Letsinvest is a P2P lending platform based in Lithuania that allows investors to invest in real estate projects. The platform is regulated by the Bank of Lithuania and operates in accordance with European Union regulations.

One of the key features of Letsinvest is its focus on transparency and risk management. The platform provides detailed information on each project to invest in, including the borrower's credit history, loan purpose, and repayment schedule. This allows investors to make informed investment decisions and manage their risk effectively.

The platform also provides detailed information on each loan opportunity, including the borrower's credit history, loan purpose, and repayment schedule. This information allows investors to make informed decisions and manage their risk effectively. Letsinvest offers attractive returns for investors, with projected annual returns ranging from 8% to 10%.

The minimum investment requirement on Letsinvest is 100 euro, which makes it accessible to a wide range of investors. The platform charges a service fee to borrowers, but there are no fees for investors. Overall, Letsinvest is a reputable crowdfunding platform that provides investors with a range of investment opportunities and a high level of transparency and risk management.

Rendity

Rendity is a real estate crowdfunding platform based in Austria that allows investors to invest in a range of real estate projects. The platform focuses on providing investors with attractive returns while helping to finance real estate development projects.

One of the key features of Rendity is its focus on transparency and risk management. The platform provides detailed information on each investment opportunity, including the project's location, developer background, and financial projections. This allows investors to make informed decisions and manage their risk effectively.

Rendity offers a range of investment opportunities, including residential and commercial real estate projects. Investors can choose to invest in individual projects or use the auto-invest feature, which automatically invests their funds in a diversified portfolio of projects. The platform offers attractive returns for investors, with projected annual returns ranging from 5% to 7%. The minimum investment requirement on Rendity is 500 euros, which makes it accessible to a wide range of investors.

Rendity also provides investors with the opportunity to earn rental income from their investments. This is a unique feature of the platform, as traditional real estate investments typically require a large upfront investment and are often illiquid. The platform charges a service fee to investors, but there are no fees for borrowers. Rendity is regulated by the Austrian Financial Market Authority, which provides an additional layer of security for investors.

Overall, Rendity is a reputable real estate crowdfunding platform that provides investors with a range of investment opportunities and a high level of transparency and risk management. Its focus on rental income and attractive returns make it an attractive option for investors looking to diversify their portfolio and earn passive income.

Max Crowdfund

Max Crowdfund is a Netherlands-based real estate crowdfunding platform that provides investors with the opportunity to invest in a range of real estate projects. The platform is regulated by the Dutch Financial Markets Authority, which provides an additional layer of security for investors.

The platform provides detailed information on each project, including the borrower's credit history, loan purpose, location and repayment schedule. This allows investors to make informed decisions and manage their risk effectively. The platform is also user-friendly, with a clean and intuitive interface that makes it easy for investors to navigate and manage their investments.

Max Crowdfund offers attractive returns for investors, with projected annual returns ranging from 5% to 10%. The minimum investment requirement on Max Crowdfund is 100 euro, which makes it accessible to a wide range of investors. The platform charges some service fees to borrowers, but there are no fees for investors. This makes it a cost-effective option for investors who are looking to diversify their portfolio and earn passive income.

Overall, Max Crowdfund is a reputable crowdfunding platform for real estate that provides investors with a range of investment opportunities and a high level of transparency and security. Its focus on user-friendliness, attractive returns, and low minimum investment requirement make it an attractive option for investors who are looking for a reliable and cost-effective way to invest in real estate.

Boldyield

Boldyield is an investment platform established in Estonia in 2019. Boldyield allows investors to invest in real estate, small and medium-sized businesses or even various maritime projects. The platform is based on the principle of crowdfunding, where offered projects are funded by many different investors rather than one. The Boldyield platform offers investments in real estate, green energy, shipping and other business projects.

All the loans issued on Boldyield platform are secured by collateral or a guarantee, so that investors' financial interests are protected, even in the event of unfavorable circumstances. The investment return on the Boldyield platform is around 11%, which is the average return in the crowdfunding market.

The average annual return on investment on the Boldyield platform is about 11 percent. Earned interest and the loan portion are paid to investors according to the approved payment schedule. The minimum possible investment amount here is only 100 EUR, so even people with small savings can invest on the Boldyield platform.

Overall, Boldyield is a reputable real estate crowdfunding platform that provides investors with a range of investment opportunities. Its focus on transparency, attractive returns, and low minimum investment requirement make it an attractive option for investors who are looking to diversify their portfolio.

Raizers

Raizers is a real estate crowdfunding platform whose registered office is located in Paris, that offers unique investment opportunities in France, Belgium and Switzerland. Raizers offer a wide range of investment opportunities, including startup companies and real estate projects. This diversity allows investors to build a balanced portfolio and spread their risk across multiple projects.

Raizers stands out for its user-friendly interface, which is easy to navigate and use. Investors can quickly browse through the various investment opportunities available, and the platform provides detailed information about each project, including the expected return on investment, the investment timeline, and the risks involved.

Raizers has a strong focus on transparency and communication, providing regular updates to investors on the progress of their investments. This level of transparency helps build trust between investors and the platform, and it also allows investors to make informed decisions about their investments.

Overall, Raizers is an excellent crowdfunding platform that offers a wide range of investment opportunities, a user-friendly interface, rigorous selection process, transparency, and security. While it may not be the right choice for everyone, for those interested in crowdfunding investments, Raizers is definitely worth considering.

Fintown

Fintown is an investment platform located in the Czech Republic, that provides an opportunity for investment in real estate developments in Europe. One of the key strengths of Fintown is its focus on transparency and providing detailed information to investors about the investment opportunities available on the platform. Each investment opportunity is accompanied by a detailed prospectus that includes information about the investment structure, the expected returns, and the risks involved.

The average interest rate on the Fintown platform is about 12%. Earned interest and the loan portion are paid to investors according to the approved payment schedule. The minimum possible investment amount here is only 50 EUR, so even people with small savings can invest in real estate projects. By the way, the owners of the platform also invest in every available project themselves.

Another notable feature of Fintown is its rigorous due diligence process, which ensures that only the best investment opportunities are made available to investors. Fintown's team of investment professionals conducts extensive research and analysis to assess the financial health and growth potential of each project before it is listed on the platform.

Overall, Fintown is a well-designed and highly transparent platform that offers investors access to a range of alternative investment opportunities. With its rigorous due diligence process and commitment to transparency, Fintown is a platform worth considering for investors looking to diversify their portfolios and explore new investment opportunities.

Crowd with Us

Crowd with Us is a UK-based crowdfunding platform launched in 2014 that specializes in real estate crowdfunding. The platform allows investors to invest in a range of property projects, including development projects, buy-to-let properties, and commercial properties. Investors can invest in projects on the platform for as little as 1 GBP, and the platform offers competitive interest rates, ranging from 15% to 18%, depending on the project and the borrower's creditworthiness.

One of the key strengths of Crowd with Us is its focus on providing high-quality investment opportunities to investors. The platform has a rigorous due diligence process that assesses each investment opportunity's financial viability and growth potential. This process ensures that only the best investment opportunities are made available to investors on the platform.

Another standout feature of Crowd with Us is its commitment to transparency and communication. The platform provides investors with regular updates on the progress of their investments and offers detailed information about each investment opportunity, including the investment structure, the expected returns, and the risks involved.

Crowd with Us also offers a range of investment options, including both debt and equity investments. This allows investors to build a diversified portfolio of real estate investments that meet their investment goals and risk tolerance. Overall, Crowd with Us is a well-designed and transparent platform that offers investors access to a range of high-quality real estate investment opportunities.

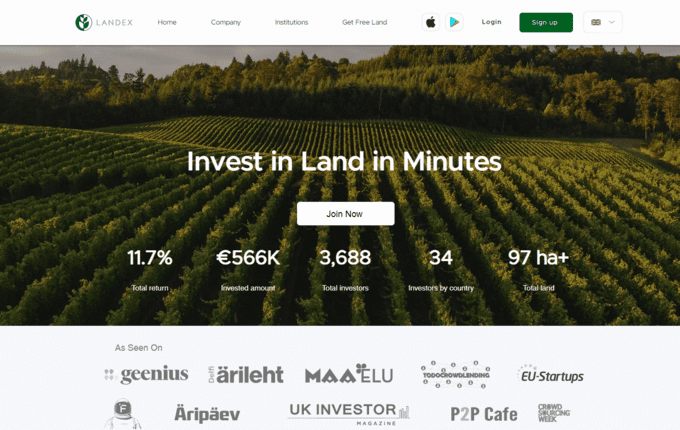

Landex

Landex is an Estonian-based peer-to-peer (P2P) lending platform that allows investors to invest in European farmland and forestland. The platform connects farmers and forest owners who need financing with investors looking for alternative investment opportunities. Investors can invest in projects on the platform for as little as 10 euro, and the platform offers competitive interest rates, ranging from 6% to 11%.

One of the standout features of Landex is its focus on sustainable and responsible investments. The platform only lists investment opportunities that meet strict environmental and social standards, ensuring that investors can invest in projects that align with their values and beliefs.

Landex also offers investors a range of tools and features to help them manage their investments, including an investment dashboard that provides real-time information about their investments' performance and a secondary market where investors can buy and sell their investments. However, it is important to note that investing in farmland and forestland can be a relatively illiquid investment, as it may take time to sell the assets. Investors should also be aware of the risks associated with investing in agriculture and forestry, including weather-related risks and the potential for crop or forest damage.

Overall, Landex is a well-designed and responsible platform that offers investors access to a range of sustainable and socially responsible investment opportunities in European farmland and forestland. With its user-friendly interface and commitment to responsible investing, Landex is a platform worth considering for investors looking to diversify their portfolios with alternative investments.

Choosing a real estate crowdfunding platform - factors to consider

Real estate crowdfunding has become a popular investment option for individuals looking to diversify their investment portfolios. Real estate crowdfunding platforms provide an opportunity for investors to invest in real estate projects with lower minimum investment requirements than traditional real estate investments. However, not all crowdfunding platforms for real estate are created equal. Let’s discuss the importance of choosing the right real estate crowdfunding platform, investment minimums and fees, types of real estate projects offered, research process, platform transparency and reputation.

Importance of choosing the right real estate crowdfunding platform

Choosing the right real estate crowdfunding platform is crucial for ensuring a sound investment strategy. Not all platforms offer the same level of transparency, or project variety, so it’s essential to research and understand the different platforms available before investing. Choosing the wrong platform can lead to poor investments, lost money, and a damaged reputation.

A reputable real estate crowdfunding platform will have a thorough due diligence process for vetting projects. This process involves analyzing the potential risks and rewards of a project before making it available for investment. Platforms with a robust due diligence process are more likely to offer sound investments with lower risk.

Additionally, a transparent platform will provide investors with clear information on the projects available, the investment process, and potential risks. Transparency is critical when investing in real estate crowdfunding, as it ensures that investors understand the potential risks and returns before making an investment.

Investment minimums and fees

Investment minimums and fees vary between real estate crowdfunding platforms in Europe. Some platforms require minimum investments of 1000 euros, while others may require 50-100 euros for one investment. Fees also vary, with some platforms charging a percentage of the investment, while others charge a flat fee. So, it’s very important to choose a platform that aligns with your investment budget and offers reasonable fees.

Types of real estate projects offered

Types of real estate projects offered is another important factor to consider when choosing a real estate crowdfunding platform. Different platforms specialize in different types of real estate projects, and investors should choose a platform that aligns with their investment goals. It is crucial to understand the types of projects offered by a platform and ensure they align with your investment goals.

Some platforms specialize in commercial real estate, such as office buildings, retail spaces, or warehouses. Commercial real estate projects may offer higher potential returns but also come with higher risks. Other platforms specialize in residential real estate, such as single-family homes or multi-unit apartment buildings. Residential real estate projects may offer lower potential returns but may be more stable and have lower risk.

In addition to the type of real estate project, investors should also consider the location of the projects. Some platforms may focus on specific regions or cities, while others may offer projects from around the country. Investors should consider their comfort level with investing in different regions and the potential impact of location on the project's success.

In summary, the type of real estate project offered by a crowdfunding platform is an essential factor to consider when choosing where to invest. Investors should consider the potential risks and rewards of different project types and how they align with their investment goals. Additionally, investors should consider the location of the projects and their comfort level with investing in different regions.

Research process

The research process is a critical step in choosing a real estate crowdfunding platform. Investors should conduct thorough research on the platform and the projects available to make informed investment decisions.

One important aspect of the research process is to review the platform's historical data and track record. This includes reviewing the platform's past investments, the returns generated, and any losses experienced. Additionally, investors should look at the platform's user reviews and ratings to gauge satisfaction levels and any potential red flags.

It’s also important to review the platform's due diligence process. A robust due diligence process can help to minimize risk and ensure that projects meet certain criteria before being offered to investors. The due diligence process should include a review of the project's financials, the developer's track record, and an analysis of the local real estate market.

Platform transparency and reputation

Transparency and reputation are critical when choosing a real estate crowdfunding website. A transparent platform will provide investors with clear information on the projects available, the investment process, and potential risks. Additionally, a platform with a good reputation will have a track record of successful investments and satisfied investors.

Final thoughts on real estate crowdfunding platforms in Europe

Real estate crowdfunding has become increasingly popular in Europe, with a growing number of platforms offering opportunities for investors to invest in real estate projects. When considering a real estate crowdfunding platform in Europe, investors should look for platforms that offer transparency, a robust due diligence process, and a track record of successful investments.

Investors should also consider the regulatory environment in Europe. Real estate crowdfunding is subject to regulations and laws that vary by country, and investors should be aware of these regulations and their potential impact on their investments.

Real estate crowdfunding can offer investors an opportunity to diversify their investment portfolios and potentially earn attractive returns. By carefully evaluating the risks and rewards of different investment opportunities and choosing a reputable platform, investors can make informed decisions that align with their investment goals.

In conclusion, real estate crowdfunding platforms in Europe offer investors a unique opportunity to invest in real estate projects with relatively low minimum investment requirements. However, as with any investment, it is important to conduct thorough research and due diligence before investing. By choosing a reputable platform and carefully evaluating the risks and rewards of different investment opportunities, investors can potentially earn attractive returns while minimizing risk.