Crowdfunding investment in real estate: opportunities and insights

Discover the world of real estate crowdfunding opportunities and seize the chance to diversify your portfolio. This article highlights the benefits, strategies, and risks associated with online real estate crowdfunding, providing valuable insights for aspiring investors. Uncover the wealth of options awaiting savvy investors in the realm of crowdfund real estate investing.

In recent years, the world of real estate investing has witnessed a remarkable transformation with the emergence of crowdfunding. Crowdfund real estate investing has opened up new doors of opportunity for both seasoned investors and individuals looking to dip their toes into the world of real estate. With the advent of online platforms, investing in real estate through crowdfunding has become more accessible, transparent, and potentially lucrative.

So, in this article, we will delve into the world of crowdfunding investment in real estate, exploring its opportunities, benefits, and how you can get started. Whether you're a budding investor or someone seeking to diversify their investment portfolio, this guide will provide you with valuable insights into the realm of online real estate crowdfunding. So, let's explore the possibilities and discover how real estate crowdfunding can pave the way to your financial goals.

Crowdfunding real estate investing: unleashing new opportunities

In the rapidly evolving landscape of real estate investing, crowdfunding has emerged as a powerful tool, transforming the way people invest in properties. Through online platforms, investors now have the opportunity to participate in real estate projects and enjoy the benefits of this alternative investment avenue.

Crowdfunding, at its core, is a collective effort of individuals pooling their resources to fund a specific project or venture. In the realm of real estate, crowdfunding brings together a community of investors who collectively finance a property or development project. The process is facilitated through online investing platforms that connect investors with real estate opportunities and streamline the investment process.

Growing popularity of online crowdfunding in real estate

Online crowdfunding in real estate has emerged as a game-changer, revolutionizing the traditional investment landscape. It opens up doors for individuals who may not have had access to the best real estate investments before. By leveraging the power of the internet and technology, top crowdfunding platforms provide a level playing field, enabling investors to participate in lucrative real estate projects with smaller capital requirements.

Over the years, crowdfunding has gained significant traction as a preferred investment avenue, particularly in the real estate sector. Its popularity can be attributed to several factors. Firstly, it offers investors the opportunity to diversify their portfolios by adding real estate assets without the need for large capital investments. Additionally, it allows investors to access a wide range of real estate crowdfunding opportunities, including residential, commercial, and even international properties, which were previously limited to institutional investors.

Moreover, top real estate investing platforms provide transparency and accessibility, offering detailed information about the projects, the expected returns, and the associated risks. This level of transparency builds trust and empowers investors to make informed decisions. As a result, more and more individuals are turning to online real estate crowdfunding as a viable investment option.

As the popularity of crowdfunding investment in real estate continues to soar, the opportunities for investors to participate in exciting projects are expanding. Through crowdfunding, investors can gain access to a diverse range of real estate crowdfunding opportunities, unlock potential returns, and diversify their investment portfolios. By harnessing the power of technology and community-driven investment models, crowdfund real estate investing has revolutionized the way people can engage with the real estate market. So, whether you are an experienced investor or a newcomer, exploring the opportunities offered by online crowdfunding in real estate can be a rewarding venture.

Understanding crowdfunding in real estate: different investment models

Crowdfunding has brought a wave of innovation to the world of real estate investing, providing us with exciting opportunities to participate in property ventures. Let’s deepen our understanding of online crowdfunding in the real estate market. Here we will explore the various types of real estate crowdfunding, including equity-based, debt-based, and rewards-based models, and how online platforms seamlessly connect investors with lucrative real estate projects.

Different types of real estate crowdfunding

- Equity-based crowdfunding: equity-based crowdfunding allows investors to acquire ownership shares in real estate properties. Investors contribute funds to a project in exchange for equity, entitling them to a share of the property's profits. This model provides investors with the potential for long-term capital appreciation and periodic income distributions.

- Debt-based crowdfunding: in debt-based crowdfunding, investors act as lenders and provide loans to real estate developers or property owners. Investors earn returns in the form of regular interest payments and the repayment of the principal amount. This model offers a more stable income stream and lower risk compared to equity-based crowdfunding.

- Rewards-based crowdfunding: while less common in real estate, rewards-based crowdfunding offers investors non-monetary incentives, such as exclusive access to amenities, discounted rates, or unique experiences related to the property. This model often complements other forms of crowdfunding and can provide additional perks to investors.

Connecting investors with real estate projects

Online crowdfunding platforms play a crucial role in bridging the gap between investors and real estate opportunities. These platforms serve as intermediaries, providing a secure and user-friendly environment for investors to explore and invest in projects. They curate a wide range of investment opportunities, presenting detailed information about each project, including property details, financial projections, and risk assessments.

Through these platforms, investors can assess the investment potential of various real estate projects, evaluate their expected returns, and make informed investment decisions. The platforms facilitate the investment process, handling legal and administrative tasks, and ensuring transparent communication between investors and project sponsors.

Online real estate crowdfunding has unlocked a realm of possibilities, offering diverse investment models and connecting investors with exciting projects they may have never had access to before. By understanding the different types of real estate crowdfunding opportunities, investors can choose the approach that aligns with their investment goals and risk tolerance. The emergence of online crowdfunding platforms has simplified the investment process, empowering individuals to explore crowdfunding investments in real estate and potentially earn attractive returns. So, whether you seek to invest in equity, debt, or enjoy exclusive rewards, crowdfund real estate investing provides a gateway to participate in the dynamic world of real estate market.

Unlocking opportunities: benefits of crowdfund real estate investing

Crowdfund real estate investing has emerged as a game-changer in the world of real estate, offering a range of benefits and opportunities for investors. So, let’s focus on highlighting the advantages of engaging in online real estate crowdfunding. By harnessing the power of technology and collective investment, now you can access a wider range of investment opportunities, overcome traditional barriers, and enjoy the potential for diversification and passive income.

Access to a wider range of real estate investment opportunities

One of the significant advantages of crowdfund real estate investing is the expanded pool of investment options. Online platforms connect investors with projects from various locations, property types, and development stages. This means that investors can diversify their portfolios by investing in residential, commercial, or even specialized real estate projects like hotels, retail spaces, or industrial properties.

Lower investment barriers and fractional ownership

Historically, real estate investing required substantial capital, making it inaccessible to many individuals. However, online real estate crowdfunding has lowered the barriers to entry by allowing investors to pool their resources and invest in fractional ownership. Through fractional ownership, investors can participate in high-value properties with smaller investment amounts, diversifying their holdings and spreading risk across multiple projects.

Potential for diversification and risk management

Crowdfund real estate investing offers the potential for diversification, which is essential for effective risk management. By investing in multiple properties or projects across different locations and property types, investors can reduce their exposure to any single investment and mitigate the impact of market fluctuations. Diversification helps balance risks and enhances the chances of achieving stable returns over time.

Passive income through rental returns

Real estate crowdfunding can provide investors with a passive income stream through rental returns. When investing in income-generating properties, such as rental apartments or commercial spaces, investors can receive regular distributions from rental income. This passive income can supplement other investment strategies and contribute to a more diversified and sustainable investment portfolio.

Ability to invest in specific property types or locations

Crowdfund real estate investing allows individuals to be more selective and targeted in their investment choices. Investors can focus on specific property types or locations that align with their preferences and investment goals. Whether it's investing in commercial properties in urban centers or residential properties in high-demand areas, crowdfunding platforms provide access to a variety of opportunities tailored to investors' interests.

As you see, engaging in crowdfund real estate investing opens up a world of possibilities for investors seeking to diversify their portfolios, generate passive income or access a broader range of opportunities. The benefits of online real estate crowdfunding, including lower investment barriers, fractional ownership, potential for diversification, passive income potential, and the ability to invest in specific property types or locations, make it an attractive option for both novice and experienced investors. With the power of technology and collective investment, investors can unlock the potential of real estate and embark on a path towards financial growth and wealth creation.

Navigating the landscape: real estate crowdfunding platforms

To harness the potential of crowdfunding investment in real estate, we must rely on specialized online platforms that connect us with lucrative investment opportunities. The real estate crowdfunding landscape is populated by various platforms that cater to investors seeking crowdfunding investment opportunities. Each platform has its own unique features, investment offerings, and target audience. Here are some of the most popular crowdfunding platforms for real estate in Europe:

Reinvest24

Reinvest24 is an Estonian real estate crowdfunding platform founded in 2017. It offers diverse real estate investment opportunities with low minimum investment requirements. Investors can choose from residential, commercial, and rental projects. The platform conducts thorough due diligence, assessing financials, developer track records, and local real estate markets. Investments start at €100 with competitive fees. Reinvest24 provides a user-friendly interface, detailed project information, and the option to invest in rental properties for steady income. It also offers an exit strategy through a secondary market. Overall, Reinvest24 is a reputable and transparent platform, ideal for diversifying real estate crowdfunding portfolios.

Estateguru

Estateguru is an Estonian peer-to-peer lending platform specializing in real estate-backed loans. Founded in 2013, it has expanded to multiple European countries. The platform offers various real estate loan types, including bridge, development, and buy-to-let loans, with competitive interest rates of 8% to 12%. With a minimum investment of €50, it caters to a wide range of investors. Estateguru features a secondary market for buying and selling investments before the loan term ends. Their comprehensive due diligence process evaluates credit history, property value, and local real estate markets. Detailed loan information is provided, including amount, rate, term, and loan-to-value ratio. Estateguru is a reputable platform offering real estate-backed loans, competitive rates, and thorough due diligence.

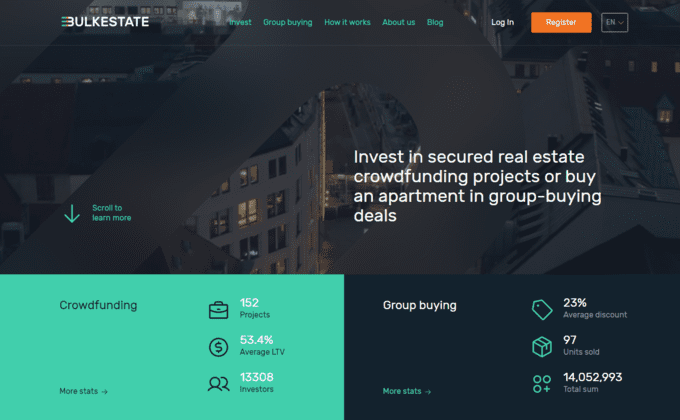

Bulkestate

Bulkestate is a real estate crowdfunding platform founded in 2016, mostly operating in Latvia and Estonia. It offers investment opportunities in development, renovation, and rental projects. Their thorough due diligence includes financial analysis, property assessment, and local market evaluation. Investors can start with just €50 and enjoy competitive interest rates ranging from 10% to 14%, based on project and borrower creditworthiness. Bulkestate provides a user-friendly platform with project details, photos, financial projections, and timelines. A unique feature is the option to invest in short-term loans for quicker returns. Additionally, there is a secondary market for early exits. With its reputable track record, comprehensive due diligence, and user-friendly interface, Bulkestate offers diverse real estate crowdfunding opportunities for investors.

Brickstarter

Brickstarter, launched in 2019, is a real estate crowdfunding platform in Spain. It offers investment opportunities in residential, commercial, and development projects. Investors can start with just €500 and enjoy competitive interest rates ranging from 7% to 10%, based on project and borrower creditworthiness. Brickstarter provides a user-friendly platform with project details, photos, financial projections, and timelines. With its reputable track record, thorough due diligence, and user-friendly interface, Brickstarter offers diverse real estate crowdfunding opportunities for investors in Spain.

Profitus

Profitus is a Lithuania-based crowdfunding platform offering diverse investment opportunities. It specializes in real estate projects and real estate-backed business loans. With a focus on real estate, Profitus provides investors the chance to invest in residential and commercial properties, offering attractive projected annual returns of 6% to 12%. Regulated by the Bank of Lithuania and complying with EU regulations, Profitus allows investors to start with a minimum of €100 without any fees, although borrowers are charged a service fee. Overall, Profitus is a reliable platform for real estate crowdfunding, presenting attractive investment options for portfolio diversification.

Lend7

Lend7 is a blockchain-based platform revolutionizing real estate investment. By tokenizing properties with non-fungible tokens (NFTs), Lend7 enables fractional ownership, making real estate accessible to more investors. NFTs ensure transparency and security through blockchain records. The platform offers diverse investment opportunities, including residential and commercial properties across different countries. Investors can earn rental income and diversify their portfolio. Lend7 disrupts traditional real estate with its innovative approach and holds promising potential for the industry's future.

Letsinvest

Letsinvest is a regulated P2P lending platform in Lithuania, specializing in real estate investments. The platform prioritizes transparency and risk management, providing detailed project information for informed investment decisions. Investors can expect attractive annual returns of 8% to 10%. With a minimum investment of 100 euros and no fees for investors, Letsinvest is accessible to a wide range of users. It offers a reputable crowdfunding experience with diverse investment opportunities and a strong emphasis on transparency and risk management.

Rendity

Rendity is an Austrian-based real estate crowdfunding platform that offers diverse investment opportunities. The platform emphasizes transparency and risk management, providing detailed information on projects, including location, developer background, and financial projections. Investors can make informed decisions and manage risk effectively. Rendity offers attractive annual returns of 5% to 7% and a minimum investment requirement of 500 euros, ensuring accessibility. The platform also allows investors to earn rental income, a unique feature in real estate crowdfunding. Regulated by the Austrian Financial Market Authority, Rendity provides a reputable and secure investment environment. Overall, Rendity is a transparent platform that offers attractive returns, making it suitable for investors seeking diversification and passive income.

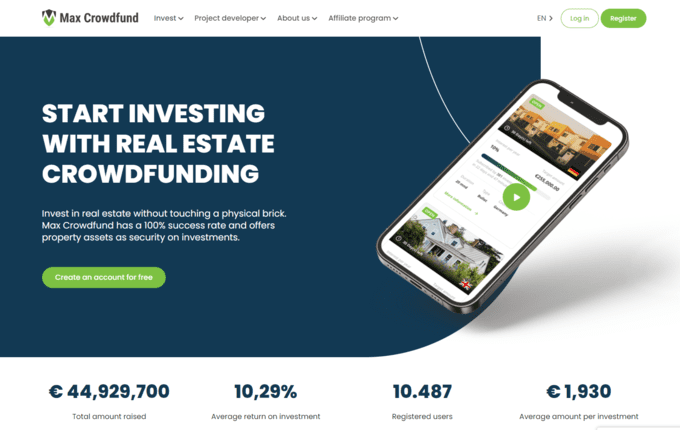

Max Crowdfund

Max Crowdfund is a Netherlands-based real estate crowdfunding platform that offers diverse investment opportunities. Regulated by the Dutch Financial Markets Authority, it provides additional security for investors. Detailed project information, including credit history, purpose, location, and repayment schedule, enables informed decision-making and risk management. The user-friendly interface simplifies navigation and investment management. With projected annual returns of 5% to 10%, the platform appeals to a wide range of investors, requiring a minimum investment of 100 euros. While borrowers incur service fees, investors enjoy fee-free transactions, making it a cost-effective option for diversification and passive income. Max Crowdfund is a reputable, transparent, and secure platform for real estate crowdfunding, ideal for reliable and affordable real estate investments.

Boldyield

Boldyield is an Estonian investment platform founded in 2019. It enables investors to fund real estate, small and medium-sized businesses, and maritime projects through crowdfunding. Investments on Boldyield are secured by collateral or guarantees, safeguarding investors' financial interests. The platform offers opportunities in real estate, green energy, shipping, and other business ventures. With an average return of 11%, Boldyield provides competitive investment returns. The minimum investment is only 100 EUR, making it accessible to individuals with modest savings. Boldyield is a reputable crowdfunding platform that prioritizes transparency, offers attractive returns, and has a low minimum investment requirement, making it a compelling choice for diversifying portfolios.

Raizers

Raizers is a Paris-based real estate crowdfunding platform that provides unique investment opportunities in France, Belgium, and Switzerland. It offers a diverse range of investments, including startups and real estate projects, allowing investors to spread their risk. The user-friendly interface makes it easy to navigate and explore investment options, with detailed project information provided, including expected returns and timelines. Raizers prioritizes transparency and communication, providing regular updates to investors. Overall, Raizers is a trustworthy crowdfunding platform offering a wide range of investment opportunities, transparency, and security. It's a recommended choice for those interested in crowdfunding investments.

Fintown

Fintown is a Czech investment platform specializing in real estate developments in Europe. It stands out for its transparency, providing detailed information and prospectuses for each investment opportunity. The platform offers an average interest rate of 12% and has a low minimum investment of 50 EUR. Fintown's rigorous due diligence process ensures high-quality investment options. Overall, Fintown is a transparent and well-designed platform for investors seeking alternative investment opportunities and diversification.

Crowd with Us

Crowd with Us is a UK-based crowdfunding platform specializing in real estate. It offers diverse property projects, including developments and commercial properties. Investors can start with just 1 GBP and enjoy competitive interest rates of 15% to 18%. The platform's rigorous due diligence ensures high-quality opportunities, while its transparency provides regular updates and detailed project information. Crowd with Us also offers both debt and equity investments for portfolio diversification. In summary, Crowd with Us is a transparent and reliable platform offering access to top-notch real estate investments.

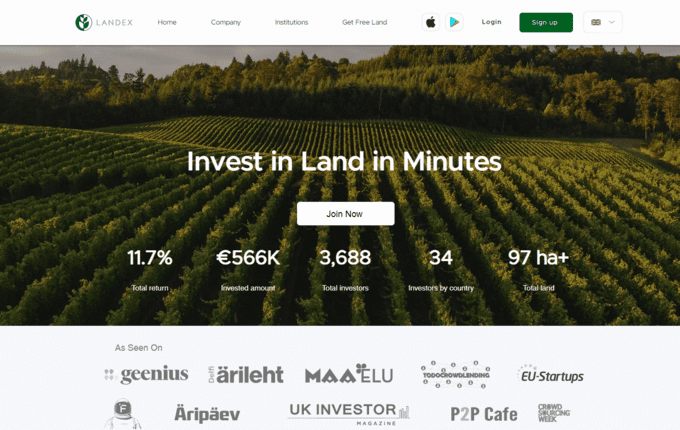

Landex

Landex is an Estonian-based P2P lending platform specializing in European farmland and forestland investments. With a minimum investment of 10 euros, investors can enjoy competitive interest rates ranging from 6% to 11%. Landex stands out for its focus on sustainable and responsible investments, ensuring projects meet strict environmental and social standards. The platform offers useful tools like an investment dashboard and a secondary market for trading investments. It's important to note that investing in farmland and forestland can be relatively illiquid and comes with associated risks. Overall, Landex is a well-designed platform that provides access to socially responsible investment opportunities in European land assets.

Exploration of real estate crowdfunding opportunities

Crowdfund real estate investing has emerged as a popular avenue for investors seeking to diversify their portfolios and participate in the lucrative world of real estate. As we conclude our exploration of real estate crowdfunding opportunities, it is essential to recap the remarkable benefits it presents to investors. By participating in online real estate crowdfunding, individuals gain access to a wider range of investment options that were once exclusive to wealthy investors or institutional players. The democratization of real estate investing allows anyone to become a part-owner in high-quality real estate projects.

One of the key advantages of crowdfund real estate investing is the lower investment barrier. Fractional ownership enables investors to pool their resources with others, reducing the amount needed to participate in high-value properties. This allows individuals to diversify their investment portfolios and spread the risk across multiple projects.

Moreover, crowdfund real estate investing provides the potential for both passive income and capital appreciation. Investors can earn regular income through rental returns while benefiting from the property's appreciation over time. This dual stream of potential returns can contribute to long-term wealth accumulation and financial security.

Top real estate investing sites offer user-friendly interfaces, extensive project information, and tools to aid investors in making informed decisions. These platforms provide transparency, support, and regular updates on investment performance, empowering investors to monitor and manage their investments effectively.

In closing, we encourage you to explore and consider the vast opportunities presented by crowdfund real estate investing. It's an exciting avenue that allows individuals to participate in the real estate market and potentially reap the rewards of this thriving industry. By conducting thorough research, understanding the risks involved, and selecting reputable crowdfunding platforms, you can embark on a journey towards building wealth and achieving your financial goals through online commercial real estate crowdfunding. Embrace the possibilities and unlock the potential that this investment strategy has to offer!