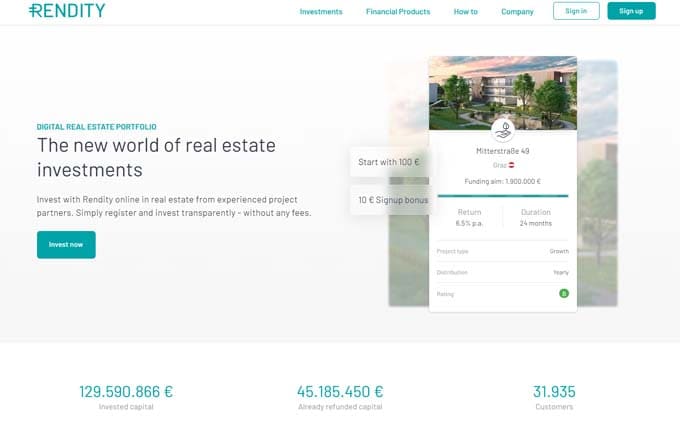

Rendity

The new world of real estate investments.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

6.50 %Min. investment

100 €Rendity investment platform.

As the popularity of crowdlending continues to grow, many investors are looking for new platforms to diversify their portfolio. One platform that has recently caught the attention of many investors is Rendity. In this review, we will take a closer look at Rendity and what makes it stand out from other crowdlending platforms.

What is Rendity?

Rendity is an Austrian-based crowdlending platform that was founded in 2015. The platform allows investors to invest in real estate projects across Austria and Germany, with the aim of providing investors with high returns while minimizing risk. Rendity offers a variety of investment opportunities, including debt and equity investments, and it has gained a reputation for providing investors with a reliable and transparent investment experience. Since the opening of Rendity, the platform already has more than 31 thousand registered clients.

How does Rendity work?

Rendity works by connecting investors with real estate developers who are seeking funding for their projects. The developers submit their projects to Rendity, which then conducts a thorough due diligence process to ensure that the project is viable and meets the platform's standards. Once a project has been approved, it is listed on the platform, and investors can invest in the project by purchasing shares or lending money to the developer.

Types of investments available on Rendity

Rendity offers various investment types to cater to the needs of different investors. Investors can choose the investment type that suits their needs and risk tolerance. Here are the types of investments available on Rendity:

- Real estate loans: investors can invest in real estate loans and receive a fixed interest rate for the duration of the loan term. These loans are secured by a mortgage on the property.

- Equity investments: Rendity also offers equity investments, which enable investors to own a share of the property. These investments have higher potential returns than real estate loans but are also riskier.

- Development projects: Rendity provides investors with the opportunity to invest in development projects, where they can fund the construction of new properties. These investments have the potential for high returns but also come with higher risks.

- Green bonds: Rendity also offers green bonds, which allow investors to invest in environmentally friendly projects such as sustainable buildings and renewable energy.

Investor protection and risk management

Rendity places a strong emphasis on investor protection and risk management. Before a project is listed on the platform, Rendity conducts a thorough due diligence process to ensure that the project meets the platform's standards. The platform also works with independent legal and technical experts to assess the risks associated with each project.

In addition, Rendity uses a special purpose vehicle (SPV) to hold the property and manage the investment. This means that investors are not directly exposed to the risks associated with the property, and their investment is protected in the event of a default. Rendity is a commercial investment adviser registered in Austria and an authorized financial investment broker in Germany regulated by the Chamber of Industry and Commerce.

Rendity auto investing

Rendity auto investing is a feature that enables investors to invest their money automatically in different projects listed on the Rendity platform. It provides a hassle-free and convenient way to invest in a diversified portfolio of real estate projects while saving time and effort. With Rendity auto Investing, investors can set their investment preferences, such as investment amount, type of project, expected returns, and more, and let the platform do the rest.

Rendity buyback guarantee

Rendity does not provide a buyback guarantee for loans in overdue arrears. On the other hand, loans financed by the platform usually are secured by a first mortgage, which provides a sufficiently tangible guarantee that the investor will be repaid for late payments.

Rendity secondary market

On Rendity there is only an initial issuance of loans (primary market). Unfortunately, there is no secondary market on Rendity (loans offered from other investors).

Investor experience and user interface

Rendity has a user-friendly platform that is easy to navigate, and investors can easily browse and invest in projects. The platform also provides investors with detailed information about each project, including the property location, investment type, and expected returns.

Investors can monitor their investments in real-time through their Rendity dashboard, which provides a detailed breakdown of their investments, earnings, and returns. The platform also offers a mobile app, which allows investors to monitor their investments on-the-go.

Rendity has a dedicated customer support team that is available to answer any questions that investors may have. The platform also provides investors with regular updates on their investments and the status of the projects they have invested in.

Conclusion

Overall, Rendity is a well-established and reliable crowdlending platform that offers investors the opportunity to invest in real estate projects across Austria and Germany. The platform places a strong emphasis on investor protection and risk management, and it has gained a reputation for providing investors with a transparent and reliable investment experience.

While Rendity's fees are slightly higher than some other crowdlending platforms, the platform's buyback guarantee and focus on investor protection make it a good choice for investors who are looking for a secure and reliable investment opportunity.

If you are interested in investing in real estate through a crowdlending platform, Rendity is definitely a platform to consider. With its user-friendly platform, strong focus on investor protection, and a variety of investment opportunities, Rendity provides investors with a reliable and transparent investment experience.

Rendity summary

Advantages:

- Most of the projects offered for financing are secured by first-line mortgages

- Possibility to invest in lending, equity and property-based projects in one place

- You can start investing on the platform from just 100 euros

- Possibility to invest in real estate projects across Austria and Germany

What you should pay attention to:

- Rendity does not provide a buyback guarantee

- There is no secondary market on Rendity

- Historical return, including return on capital gains, is around 6.5%, below the crowdfunding market average