EstateGuru

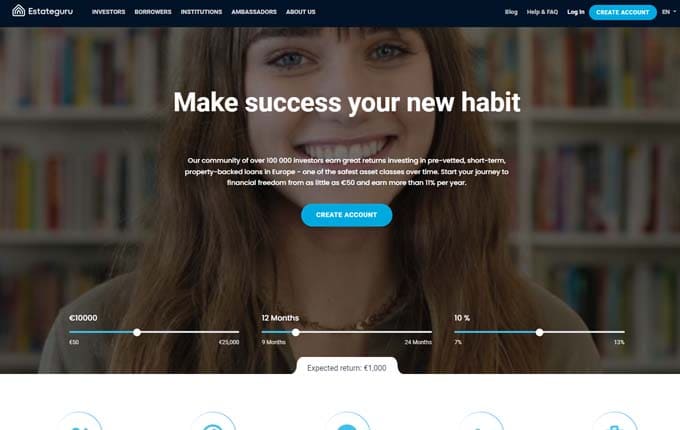

Make success your new habit.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

11.00 %Min. investment

50 €Estateguru crowdfunding platform review.

Esateguru is an investment platform that opened in 2014 and offers the opportunity to invest in real estate loans. All loans financed on the platform are secured by real estate collateral, which significantly reduces the investment risk. Since its launch, more than 125,000 investors from more than 100 different countries have registered on the Estateguru platform. Estateguru is headquartered in Estonia. The platform has now also opened offices in Latvia, Lithuania, the United Kingdom, Finland, Germany and Armenia. We invite you to read EstateGuru's reviews and a detailed overview of the platform.

General information about the Estateguru platform

In principle, the Estateguru platform is a relatively safe way to invest in real estate secured loans. Almost every loan financed on the platform is secured by a first-ranking mortgage, so that in the event of a possible default of the borrower, the investors' interests will be well protected. Residential and commercial real estate or land is the most common choice of collateral. To date, more than 3 400 different real estate projects have been financed on the platform.

The Estateguru platform targets a wide range of customers and can offer different types of loans to companies looking for a loan. As a result, investors have the opportunity to invest in real estate development, mezzanine and conventional business loans on one platform. The real estate investment platform has a historical return of 11%, an average maturity of 14 months and a historical LTV of 60%. Estateguru is based in Estonia, and therefore mainly invests in real estate projects developed in the Baltic region.

Estateguru buyback guarantee

In the event of a delay in the repayment of a loan, the Estateguru investment platform does not provide its investors with a loan buyback guarantee. On the other hand, most of the loans financed on the platform are secured by a first ranking mortgage, which allows for a reliable protection of investors' rights. Mention should also be made of the Instant Exit programme, which allows the investor to sell his loan claims immediately and recover the money invested. However, in this case, the selling price of the loan will be 35% lower than the original value of the investment, and the Instant Exit programme itself has certain limitations.

Estateguru secondary market

Estateguru has an active secondary market. All investors registered on the platform can sell and buy investments that are not overdue. When selling an investment on the secondary market, the seller is charged a 2% fee on the value of the transaction. The buyer is not subject to any fees for secondary market transactions. Investments purchased on the secondary market are subject to exactly the same conditions and obligations as investments on the primary market. The liquidity of Estateguru's secondary market, as in all other investment platforms, is highly dependent on investor activity. In other words, there is no guarantee that an investment will be sold quickly on the secondary market.

Estateguru autoinvesting feature

The Estateguru platform has an automatic investment feature. However, this feature is called there "investment strategies". Investment Strategies is an auto-investment tool that allows you to select auto-investment criteria based on predefined strategies. Once the desired investment strategy has been selected, the system will continue to invest automatically, selecting only those projects that meet the defined criteria. The minimum amount for automatic investment is €50. The selected investment strategy can be changed or deactivated at any time.

The following investment strategies are currently available:

- Conservative - the optimal balance between the value of the deposit and the investment return. Suitable for investors seeking stability and security.

- Balanced - suitable for more risk-tolerant investors who are interested in maximising the return on their investment portfolio.

- Individual - for more experienced investors who can tailor their own auto-investment strategy based on the LTV indicator, the type of collateral offered or the type of loan.

Accountability

The Estateguru website provides detailed historical and up-to-date data on the platform's activities. The data is available at: https://estateguru.co/portal/statistics/. Here you can find detailed information on the structure of the Estateguru platform's loan portfolio, loan repayment dynamics, recovery performance and other statistics. Estateguru has also published detailed audited annual reports. However, the most recently published audited report is for the 2019 performance year.

Investing on the Estateguru platform

The Estateguru platform is open to anyone aged 18 years and over with a bank account in any bank in the European Economic Area (EEA). The platform's administration thoroughly analyses each loan application and makes a decision only after assessing the developer's credit history, the business plan of the real estate project to be developed, the proposed collateral and other relevant indicators. Statistically, the platform approves only about 10% of all financing applications received from property developers. Despite the strict selection of projects, Estateguru is usually able to offer its investors a wider choice of investment properties than other best real estate investment platforms.

Estateguru investing - registration and first investment

It is very easy to register and start investing on the Estateguru platform. The process of registering as a new investor and confirming your account usually takes one day, or a few days at most. All new investors have to go through the so-called "Know your client" procedure. This requires the completion of a data form and the provision of basic personal information during registration. The platform also asks for a photo ID. Once this is done, the investor's account is confirmed and the investment can start.

Before you can start investing, you first need to fund your account with the desired amount of money. A bank transfer is usually credited within 1-3 days, depending on the country and bank. Once the investment money has reached your personal account, you can start investing in property projects you like. The historical return on investment of the Estateguru platform is 11%, but the final result depends on the investment strategy chosen. It should also be noted that the minimum investment on the Estateguru platform is just €50, so almost anyone can start investing in real estate here.

Estateguru reviews and summary

Benefits:

- The platform is supervised by financial supervisors

- A functioning secondary market

- Automatic investment options

- Most loans are secured by first mortgages

- Particularly low rate of outstanding and written-off debts

- Start investing from just €50

What to look out for:

- 2% tax on the sale of an investment on the secondary market

- No buyback guarantee

Latest projects.

Make success your new habit.

#8803Developmentloan-4.stage(Lithuania)

#28394918Bridgeloan-1.stage(Lithuania)

#62065160Bridgeloan-1.stage(Lithuania)

#59342478Businessloan-1.stage(Latvia)

#7259Developmentloan-10.stage(Latvia)

#18577989Developmentloan-4.stage(Lithuania)

#99857801Businessloan-4.stage(Lithuania)

#90198900Bridgeloan-1.stage(Estonia)