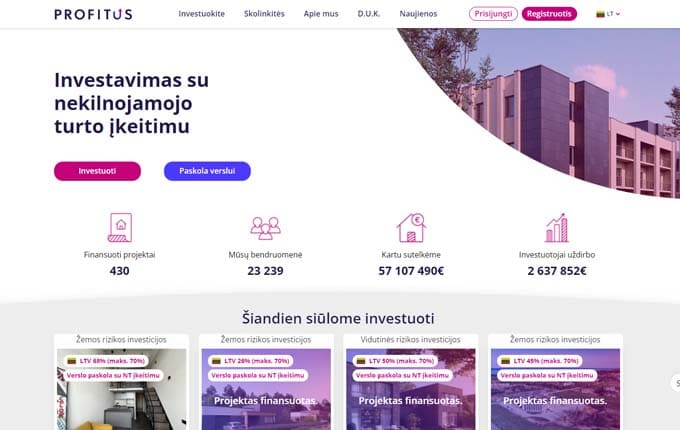

Profitus

Property-backed investments.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

10.50 %Min. investment

100 €Overview of the Profitus investment platform.

Profitus is a crowdfunding platform established in Lithuania in 2018, which provides the opportunity to invest in real estate. Although the platform has been operating for a relatively short period of time, it has already managed to earn the trust of both investors and property developers. More than 6,000 investors are actively investing on Profitus and have already financed more than 750 real estate projects. Profitus is supervised by the Bank of Lithuania, so all the platform's processes are regulated by legislation and controlled by the responsible authorities. Below you can find Profitus reviews and an overview of the platform.

Information about the Profitus platform

The Profitus platform works on the principle of crowdfunding, where real estate projects can be financed by hundreds of different investors. All loans financed on the platform are secured by a first mortgage on the real estate, so investor risk is minimal. Even if the loan defaults, the mortgaged property will be auctioned and the money returned to the investors. As collateral for the loan, land plots or commercial and residential real estate are usually accepted from project promoters.

The Profitus team is made up of strong specialists in their field, who responsibly assess the riskiness of projects proposed by developers for financing. Therefore, all projects submitted to investors are selected on the basis of high risk and financial criteria. The historical return of the Profitus platform to its investors is 7-14%, the average maturity of the loans financed is 12 months and the average LTV of the loans is 56%. The platform gives the highest priority to financing real estate projects developed in Lithuania.

Profitus buyback guarantee

The Profitus platform does not provide a buyback guarantee for loans in overdue arrears. On the other hand, all real estate loans financed on the platform are secured by a first mortgage, which provides a sufficiently tangible guarantee that the investor will be repaid for late payments.

Profitus secondary market

Profitus has an active secondary loan market, which greatly increases the liquidity of investments for those investing on this platform. On the secondary market, investors can buy and sell active or overdue investments while the project under development is pending completion. When an investment is sold, the seller is charged a 2% fee on the final sale price. Buyers, on the other hand, are not subject to any fees for using the secondary market. The liquidity of the secondary market on the Profitus platform depends mainly on the activity and interest of the investors registered here, which is why it may not always be possible to sell the desired investments quickly.

Profitus autoinvesting feature

The Profitus platform has an auto-investment feature that is available to all registered users. If you choose to invest automatically, the system will invest the funds itself in all the loans on the Profitus platform that meet the criteria set by the investor. In other words, the auto-investment function ensures that all projects that meet the criteria will be invested. The minimum amount of money that can be invested by automatic investment is €100. With auto-investment, it is possible to change the criteria previously set at any time, or simply switch off the functionality itself.

Accountability

Profitus provides summary data on the performance of the platform on its website. The data is available at: https://www.profitus.com/statistika. Here you can see primary and secondary market statistics, investor earnings and the dynamics of the changes in the platform's loan portfolio. Profitus does not publish audited annual reports on its activities.

Investing money on the Profitus platform

The Profitus platform is open to anyone aged 18 and over. On average, only about 1/5 of all funding applications received are approved and published by the platform administration. This shows that the Profitus team analyses and evaluates each funding application received from real estate developers in great detail. Like other successful real estate investment platforms in Europe, Profitus focuses on the quality of the projects offered to investors rather than the quantity.

Profitus Investing - registration and first steps

To start investing on the Profitus platform, you first need to register and confirm your personal account. Registration usually only takes a few minutes and only requires your basic contact details. The personal investor account is validated by means of a "Know your client" authentication process.

Identity can be verified via Paysera or Ondato systems. If you choose to verify your identity via Paysera, you will need to open an account with this electronic money institution and make all investments from it. Ondato will allow the investor to use the Trusty payment system, which allows payments to be made from all banks in Lithuania and many banks in Europe. Once all the required personal data has been provided, the personal account is approved and the investment can start.

Before investing, you should top up your investment account with the desired amount of money. Then all you have to do is get to know the active investments, choose the projects you prefer and put your money to work. The historical return of the Profitus investment platform is just over 9%. Don't forget that you can also use the auto-invest feature to invest. With a minimum investment of €100 per real estate project, it is clear that almost anyone can invest on Profitus. Interest on the financed loan is usually paid quarterly and the investment is repaid in full at the end of the term.

Profitus reviews and summaries

Benefits:

- The platform is supervised by the Bank of Lithuania

- A functioning secondary market

- Automatic investment option

- The loans financed are secured by a first-ranking mortgage

- Particularly low rates of outstanding and written-off debt

- Start investing from €100

What to look out for:

- 2% tax on the sale of an investment on the secondary market

- No buyback guarantee