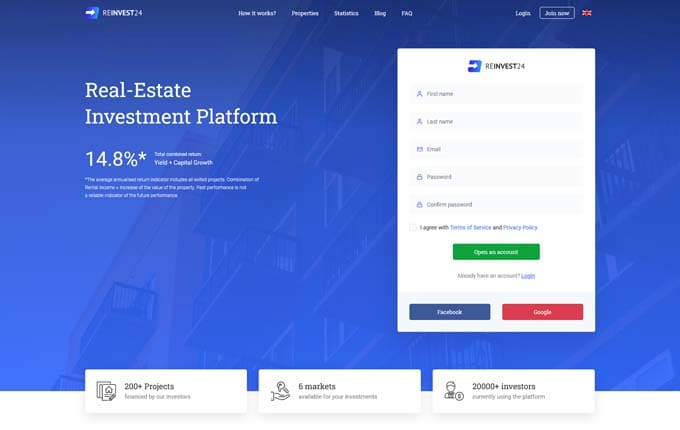

Reinvest24

Real estate investment platform.

Type of investment

Type of funding

Regulated

Buyback guarantee

Secondary market

Auto invest

Main currency

EUR (€)Avg. return

14.80 %Min. investment

100 €Reinvest24 investment platform.

Reinvest24 is an investment platform opened in Estonia in 2018, which gives the opportunity to invest money in the real estate sector. The platform let’s you invest in real estate projects under development, various loans with real estate collateral or in real estate rental. In other words, on the Reinvest24 platform you can invest not only in money lending, but also in property ownership. Such a wide choice of investment methods allows investors to earn from interest and capital gains.

Since the opening of Reinvest24, the platform already has more than 19 thousand permanent registered investors. Although the main headquarters of Reinvest24 is located in Estonia, the platform also has its representative offices in Germany, Spain and Moldova, so it can offer a really wide geography of real estate projects. We invite you to get a closer look to Reinvest24 platform in our review.

Investment opportunities on the Reinvest24 platform.

First of all, it should be noted that the Reinvest24 platform focuses on a fairly wide range of clients, so it can offer various investment methods to clients who want to invest their money effectively. At Reinvest24, it is possible to invest in real estate projects implemented by the platform itself, loans secured by real estate collateral, or rental property. However, in the case of this platform, it is very important to keep in mind that for each newly developed object or rental property, Reinvest24 creates a so-called special purpose vehicle (SPV). In general, special purpose vehicles allow to isolate the projects under development from each other and ensure that the results of one project do not affect the rest of the projects. On the other hand, the activities of special purpose companies are associated with additional management, transparency and capital risks, which every investor should assess.

To date, more than 180 different projects in the real estate sector have already been financed with the help of the Reinvest24 platform. Reinvest24 historical return, including return on capital gains, is 14.8%, slightly above the crowdfunding market average. However, it should be borne in mind that some projects published on the Reinvest24 platform are subject to a 1% success fee that is paid paid at the end of the project term. The average term of projects financed on the platform is 10 months, so Reinvest24 can also be chosen by people looking for short-term investment opportunities.

Reinvest24 buyback guarantee

Reinvest24 does not provide its investors with a buyback guarantee of of overdue loans. On the other hand, most of the projects financed on the platform are secured by a first-rate mortgage, which allows for relatively reliable protection of investors financial interests in case of insolvency of the project developer or other financial problems.

Reinvest24 secondary market

Reinvest24 has an active secondary market where all investors on the platform can buy and sell investments. Fees applied in the secondary market depend on the project. If the project is subject to a success fee, secondary market brokerage fee in the amount of 1% is paid by the seller, if there is no success fee in the project, then brokerage fee in the amount of 1%is paid by the buyer.

Reinvest24 autoinvesting

Currently, the Reinvest24 investment platform does not have an automatic investment function. On the other hand, the supply of new projects on the platform is not as large as on P2P and similar investment platforms, so it is quite convenient to invest manually.

Accountability

Detailed statistics of Reinvest24, where you can find the most important performance indicators of the platform, can be found on the website at: https://www.reinvest24.com/en/statistics.

Investing on the Reinvest24 platform.

To start investing, you will first need to register and verify your identity. When registering, you will need to provide your basic personal data, and you can confirm your identity by sending photos of your passport or ID card. The registration and approval process for a new investor usually takes no more than a few days. After submitting all the requested data and documents, the investor's account is activated.

When starting investing, you first need to send the desired amount of money to your investment account. You can do this with a regular SEPA bank transfer or a transfer from Revolut, Paysera or similar payment systems. The completed order is usually credited on the same day. Once the investment money reaches your account, you can start investing in the real estate projects you like the most. The minimum investment in one project is 100 euros, so anyone who wants to can invest on the Reinvest24 platform.

Remember, although the historical investment return of the Reinvest24 platform, together with capital gains, is as high as 14.8%, the final financial result will directly depend on the investment strategy you choose.

Reinvest24 summary.

Advantages:

- The platform has a secondary market

- Most of the projects offered for financing are secured by first-line mortgages

- The possibility to invest in lending and equity-based projects in one place

- You can start investing on the platform from just 100 euros

What you should pay attention to:

- 1% brokerage fee in the secondary market for the seller or the buyer

- Special purpose companies are created for real estate projects developed by the platform

- 1% success fee is paid at the end of the project