Guide to crowdinvesting: how to find the best crowdinvesting platforms?

Looking to invest in promising startups or raise funds for your business? Discover the world of crowdinvesting and find the best crowdinvesting platforms for your needs with our ultimate guide. Discover the benefits of being a crowdinvestor and how to maximize your returns with the top crowdinvesting opportunities.

Crowdinvesting has emerged as a popular way for entrepreneurs to raise capital and for investors to invest in exciting opportunities. In this article, we will explore the basics of crowdinvesting, how it works, and the benefits it offers to both entrepreneurs and investors. Additionally, we will highlight some of the best crowdinvesting platforms available to help you make informed decisions and find the right platform for your investment needs. So, let's dive in and learn more about the world of crowdinvesting!

What is crowdinvesting and how does it differs from other investments?

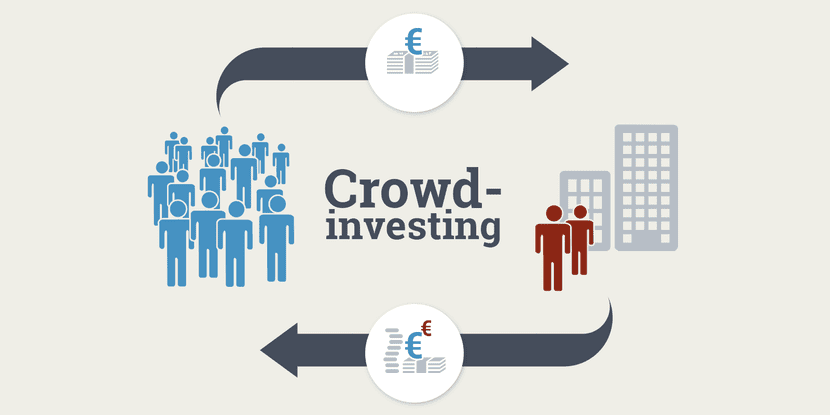

Crowdinvesting is a relatively new form of investment that has been gaining popularity in recent years. It involves pooling small amounts of money from a large number of individuals to fund a project or business venture. The process is facilitated by crowdinvesting platforms, which provide a space for investors and entrepreneurs to connect.

Unlike traditional investment options, such as stocks, bonds, and mutual funds, crowdinvesting allows individuals to invest in businesses or specific projects. Investors have the opportunity to support ventures they are passionate about and believe in, while entrepreneurs have access to a new source of funding.

Crowdinvesting has become an increasingly important part of the investment landscape, particularly for small and medium-sized enterprises (SMEs) that may struggle to secure funding through traditional channels. It offers a new avenue for entrepreneurs to access capital and grow their businesses, while also giving investors access to a wider range of investment opportunities.

Moreover, the best crowdinvesting platforms have made the process of investing more accessible and convenient than ever before. Investors can browse and invest in projects from the comfort of their own homes, while entrepreneurs can reach a larger pool of potential investors than they would through traditional fundraising methods. Crowdinvesting is an innovative and exciting form of investment that offers unique opportunities for both investors and entrepreneurs. With the rise of crowdinvesting platforms, it is easier than ever before to find and invest in the top crowdinvesting opportunities.

How crowdinvesting works?

Crowdinvesting is a relatively new investment concept that allows individuals to invest in small and medium-sized businesses through online platforms. The process is straightforward: a business seeking funding creates a campaign on a crowdinvesting platform, providing information about its business plan, financial projections, and the investment opportunity. Then, individual investors, also known as crowdinvestors, can browse and invest in the campaign using the platform's online tools. In exchange for their investment, crowdinvestors receive equity or debt in the business, depending on the investment structure.

In general, the investing platform acts as an intermediary, facilitating the transaction and managing the investment on behalf of both the business and the investors. This way, crowdinvesting offers a simple and convenient way for individuals to invest in exciting business opportunities that were previously only available to institutional investors.

Different types of crowdinvesting models

Crowdinvesting offers several different investment models for both investors and businesses. Here are some of the most common types of crowdinvesting:

- Equity crowdfunding: this is the most common type of crowdinvesting, where investors buy a stake in a business in exchange for equity ownership.

- Debt crowdfunding: in this model, investors lend money to businesses in exchange for interest payments over time.

- Revenue-sharing: this model allows investors to receive a percentage of a company's revenue in exchange for their investment.

- Reward-based crowdfunding: in this model, investors receive non-financial rewards, such as a product or service, in exchange for their investment.

Benefits of crowdinvesting

One of the main benefits of crowdinvesting is the accessibility of investment opportunities for retail investors. Crowdinvesting platforms have made it possible for individuals to invest in small startups and small businesses, which were previously only available to institutional investors or high net worth individuals.

Another advantage of crowdinvesting is the diversification of the investment portfolio. By investing in a range of different businesses, investors can spread their risk and minimize the impact of any individual business's failure on their overall portfolio.

Crowdinvesting can also offer higher potential returns compared to traditional investment options. As startups and small businesses have a higher risk, they also have the potential for higher returns if they succeed. By investing in these businesses through crowdinvesting, investors can potentially earn a greater return on their investment.

Finally, crowdinvesting provides support for small and medium-sized businesses, which may otherwise struggle to access capital through traditional means. By investing in these businesses, investors can help to drive innovation and growth, while also potentially earning a return on their investment.

Overall, the benefits of investing in crowdfunding make it an attractive option for both investors and businesses looking for alternative funding sources. With the rise of crowdinvesting platforms, there are more opportunities than ever before to access the benefits of this investment option.

List of the best platforms in crowdinvesting market

As crowdinvesting gains popularity, numerous crowdfunding platforms have emerged for both entrepreneurs and investors. With so many options available, choosing the right platform can be overwhelming. In this section, we'll provide a rundown of some of the best crowdinvesting platforms available today.

- Kickstarter - launched in 2009, is popular for creative projects such as art, film, music, and design. It follows an all-or-nothing funding model where no funds are collected if the campaign doesn't reach its goal.

- Seedrs - launched in 2012, is an equity-based platform that allows investors to own a percentage of the business they are supporting. It also offers a secondary market where investors can buy and sell shares.

- Patreon - launched in 2013, is a subscription-based crowdinvesting platform for artists and creators. It offers ongoing support for ongoing projects.

- Indiegogo - launched in 2008, offers both rewards-based and equity-based crowdinvesting and is popular for innovative products and technologies. It follows a flexible funding model where funds are still collected even if the campaign doesn't reach its goal.

- GoFundMe - launched in 2010, is ideal for personal causes and charities, and offers both all-or-nothing and flexible funding models.

- Wefunder - launched in 2012, is an equity-based crowdinvesting platform in the United States that allows non-accredited investors to invest in private companies.

- WiSeed - is an equity-based crowdinvesting platform focused on funding small and medium-sized businesses in France, launched in 2008.

- Crowdcube - launched in 2011, is an equity-based crowdinvesting platform in the United Kingdom that allows investors to own shares in private companies.

- Reinvest24 - launched in 2018, is a top real estate investing platform in Europe that offers loan-based and equity-based investment opportunities in rental properties.

- Max Crowdfund - launched in 2019, is a real estate crowdinvesting platform in the Netherlands that offers investment opportunities in commercial and residential properties.

While these platforms represent a diverse range of funding models and industries, there are many other crowdinvesting platforms available to suit your investment needs. Choosing the right crowdinvesting platform is crucial to the success of your investment journey, so it's essential to conduct thorough research before making any investment decisions.

How to become a successful crowdinvestor?

If you're interested in becoming a successful crowdinvestor, there are several important things to consider. Firstly, it's crucial to conduct thorough research on investment opportunities before committing any funds. This includes analyzing the business plan, financial statements, and management team to determine the potential for growth and success.

Another key factor in successful crowdinvesting is portfolio management and risk mitigation. Diversification of your investment portfolio across multiple companies and industries can help spread risk and reduce exposure to any single investment. It's also important to keep an eye on your investments and adjust your portfolio as needed to maximize returns and minimize risk.

Staying up-to-date with the latest trends and regulations in the industry is also critical to becoming a successful crowdinvestor. This includes monitoring changes in the regulatory environment and industry trends, such as the rise of sustainable and socially responsible investing.

Overall, becoming a successful crowdinvestor takes time, effort, and careful consideration of investment opportunities, portfolio management strategies, and industry trends. By following these tips and staying informed, you can increase your chances of success in the exciting world of crowdinvesting.

Making the most of crowdinvesting: recap and final thoughts

As we come to the end of this article, let's recap some of the key points about crowdinvesting. It offers accessibility to investment opportunities for retail investors, diversification of investment portfolio, higher potential returns compared to traditional investment options, and support for small and medium-sized businesses. Additionally, we explored how crowdinvesting works, different types of crowdinvesting models, and how to become a successful crowdinvestor.

To ensure success in crowdinvesting, it is crucial to select the right platform that suits your specific needs and goals. Conducting thorough research on investment opportunities and implementing effective portfolio management and risk mitigation strategies are also important. By staying up-to-date with the latest trends and regulations in the industry, you can maximize your chances of success and make the most of crowdinvesting.

Remember, the world of crowdinvesting is constantly evolving, and there are many best crowdinvesting platforms available to explore. So, take the time to find the right platform, develop a sound investment strategy, and start your crowdinvesting journey today!