The complete guide to understanding the investment process: steps, structure, and strategies

Learn about the investment process, what it is, the structure of the process, and the steps involved in making informed investment decisions. Discover the key steps to successful investing with this comprehensive guide to the investment process.

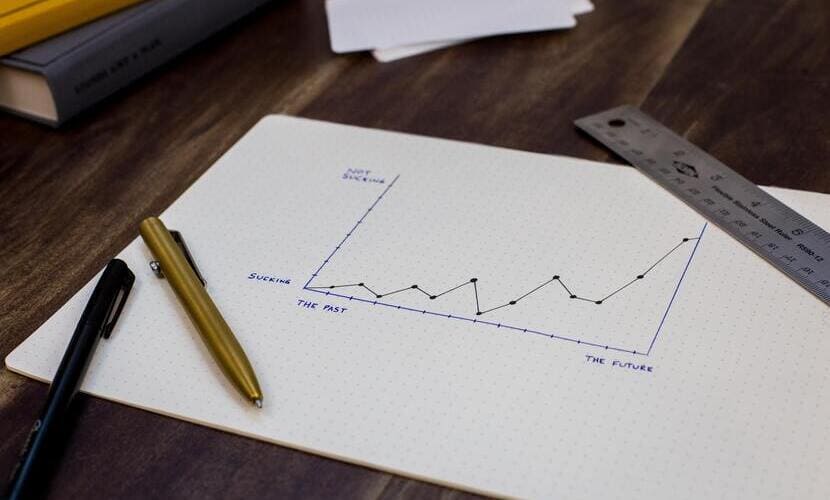

Investing can be overwhelming, especially for new investors who are not familiar with the investment process. An investment process refers to a set of guidelines that an investor follows when selecting, managing, and monitoring investments to achieve their financial goals. It provides a structured approach to making investment decisions that are grounded in research, analysis, and experience.

What is an investment process?

The investment process typically involves several steps that help investors identify their investment objectives, evaluate potential investment opportunities, construct a well-diversified portfolio, monitor investments, and adjust the portfolio as necessary to reflect changes in market conditions or investment goals. Understanding the investment process is critical for investors who want to achieve their financial goals and make informed investment decisions.

Why is a structured investment process so important?

A structured investment process is essential for successful investing. Firstly, it provides a so-called systematic approach, which helps investors stay on track and avoid making impulsive decisions. Also, it increases consistency of investment decisions over time, reducing the impact of human emotions on investment choices. Finally, a structured investment process can help investors manage risk by diversifying their portfolio and monitoring the performance of their investments.

Furthermore, a structured investment process can improve investment performance by providing a framework for selecting investments, monitoring their performance, and making adjustments as necessary. Additionally, it can help to hold investors accountable for their investment decisions, making it easier to track performance and adjust strategies as needed.

Importance of a systematic investment process

An investment process provides a structured approach to investing that helps to reduce the emotional biases that can lead to poor investment decisions. Having a systematic process helps to ensure that investment decisions are based on sound principles and are aligned with the investor's objectives and risk tolerance. A structured investment process also helps to keep investors on track, as it provides a clear roadmap for how investments should be managed over time. In this way, a structured investment process can help investors to achieve their long-term investment goals while minimizing the risks associated with emotional decision-making.

Main steps in the investment process

The investment process can be broken down into several key steps, each of which is essential to achieving long-term investment goals. These steps typically include establishing investment objectives, determining risk tolerance, asset allocation, security selection, and portfolio monitoring and rebalancing.

By following a structured process, investors can develop a well-diversified portfolio tailored to their individual needs and risk preferences. Each step of the process contributes to achieving investment goals, from setting clear objectives to monitoring the portfolio's performance and making necessary adjustments to maintain an appropriate risk profile.

Step 1: Establish investment objectives

Start by defining your investment goals. What do you want to achieve? This involves identifying the goals you want to achieve through investing, such as accumulating wealth, generating passive income through investing, or preserving capital. Investment objectives should be specific, measurable, and achievable, with a defined time horizon. Without clearly defined investment objectives, you may find it challenging to make informed investment decisions and measure your success over time.

This step is crucial as it helps to create a clear direction for your investments and guides the rest of the investment process. By clearly defining your investment objectives, you can better understand what you are investing for and what risks you are willing to take to achieve your goals. This will help guide your investment decisions in the future, ensuring that you stay focused on your objectives and make the right investment choices to achieve them.

Step 2: Determine risk tolerance

Determining risk tolerance is an important step in the investment process. Risk tolerance is a measure of how much volatility you can tolerate in your investment portfolio. In other words, it refers to the amount of risk an investor is willing to take when investing their money. Risk tolerance is affected by various factors, including age, investment experience, financial goals, and personal circumstances. It's important to understand your risk tolerance, as it helps to identify the amount of risk you are willing to take on in pursuit of your investment objectives.

Once an investor has determined their risk tolerance, they can make informed decisions on asset allocation and security selection that align with their investment goals. By understanding their risk tolerance, investors can choose investments that align with their goals and minimize the potential for financial losses. It's important to strike a balance between risk and reward, as investing in high-risk assets can result in significant gains, but it can also result in significant losses.

Step 3: Asset allocation

Asset allocation is the process of dividing your investment portfolio among different asset classes such as stocks, bonds, commodities, real estate and cash. The purpose of asset allocation is to create a diversified portfolio that can help you achieve your investment objectives while managing risk. The ideal asset allocation will depend on your risk tolerance, investment objectives, and time horizon.

Proper asset allocation can help investors to reduce risk, optimize returns, and achieve their long-term financial objectives. By diversifying investments across different asset classes, investors can minimize the impact of market volatility and reduce the overall risk of their portfolio. Furthermore, asset allocation helps investors identify their risk tolerance, which is critical in selecting the most suitable investment options.

Step 4: Security selection

Once you have determined your asset allocation, you can begin to select individual securities and make up your investing portfolio. This step involves analyzing and researching different securities such as stocks, bonds, mutual funds, ETFs, crowdfunding and P2P lending platforms, commodities and other investment options to identify the best fit for your goals. The aim is to pick the right mix of securities that align with the investor's investment objectives and achieve optimal returns while minimizing risk.

The key factors to consider while selecting securities include the security's financial health, market trends, and economic indicators. A diversified portfolio helps investors to reduce their exposure to risks and ensures they don't have all their eggs in one basket. A well-diversified portfolio has a mix of securities that behave differently in different market environments.

Step 5: Portfolio monitoring and rebalancing

Portfolio monitoring and rebalancing is the final step in the investment process, and it involves keeping a watchful eye on your portfolio's performance to ensure it remains aligned with your investment objectives. Over time, some of your investments may grow faster than others, throwing off your asset allocation and risk tolerance. In such cases, you'll need to rebalance your portfolio by selling some assets and buying others to restore the balance.

Regular monitoring and rebalancing can help you avoid overexposure to certain investments and reduce the risk of losses due to market volatility. By periodically reviewing your portfolio's performance, you can also adjust your investment strategy to reflect changes in your financial situation or investment goals. This step is crucial for long-term investment success and helps ensure that you stay on track to achieve your financial goals.

So, by following these five steps, you can build a diversified investment portfolio that aligns with your investment objectives and risk tolerance. Remember that investing is a long-term process, and it's important to remain disciplined and patient, especially during periods of market volatility.

Benefits of following an investment process

Following an investment process has numerous benefits that can help investors make better decisions, manage risk, and achieve more consistent performance over time. By establishing clear investment objectives, determining risk tolerance, creating a well-diversified asset allocation, carefully selecting securities, and regularly monitoring and rebalancing their portfolios, investors can better position themselves to achieve their financial goals.

Moreover, a structured investment process can help investors avoid emotional decision-making, which can lead to poor investment choices and missed opportunities. Additionally, a consistent investment process helps to remove subjectivity from investment decisions, creating a more objective and disciplined approach to investing. Finally, a systematic investment process helps investors to manage risk effectively and achieve a smoother and more predictable investment experience.

Better investment decision making

A structured investment process can help to improve investment decision making. By following a systematic approach, investors can more easily assess their investment objectives, risk tolerance, and asset allocation strategy. In addition, having a process in place can help investors to avoid making impulsive decisions based on short-term market movements, which can lead to poor investment outcomes. Overall, a structured investment process can help investors to make more thoughtful, informed decisions, and stay on track with their long-term investment objectives.

Improved risk management

Following an investment process helps in identifying and managing investment risks. By identifying and quantifying risks, investors can make informed decisions about the types of investments that they want to hold in their portfolio. This can help to mitigate risks and reduce the potential for significant losses. By incorporating risk management into the investment process, investors can have more confidence in their investment decisions and can be better positioned to achieve their long-term investment objectives.

More consistent performance over time

Following a structured investment process can help to achieve more consistent performance over time. By establishing clear investment objectives and risk tolerances, selecting appropriate asset allocation, and monitoring and rebalancing portfolios, investors can avoid making impulsive investment decisions based on short-term market trends or emotional reactions. This helps to reduce the likelihood of significant losses during market downturns and can result in more consistent returns over the long term.

Common mistakes to avoid in the investment process

Investing is a critical part of building long-term wealth. However, making the right investment decisions can be challenging, and many investors make mistakes that can harm their portfolios. By avoiding common mistakes in the investment process, investors can help ensure they meet their long-term financial goals. In this section, we'll discuss some of the most common investment process mistakes to avoid.

1. Not defining investment objectives clearly

Not defining investment objectives clearly is a common mistake that investors make during the investment process. Investment objectives should be specific, measurable, achievable, relevant, and time-bound. By having clear investment objectives, investors can have a better understanding of what they are trying to achieve and how to measure their progress. Without clear objectives, investors may be tempted to make hasty investment decisions, which can lead to poor performance and lower returns. Therefore, it is essential to spend time defining investment objectives that are consistent with one's financial goals and risk tolerance.

2. Not considering risk tolerance

One common mistake that investors make in the investment process is not considering their risk tolerance. Risk tolerance refers to the level of financial risk an investor is willing and able to take. It is important to evaluate your risk tolerance as it can help you determine the types of investments you are comfortable with and the amount of risk you can take on. Ignoring your risk tolerance can lead to investing in securities that are not appropriate for your risk profile and may result in losses that are higher than your comfort level. Therefore, it is important to understand your risk tolerance before investing in any security.

3. Not diversifying investments

Not diversifying investments is a common mistake that investors make, which can lead to significant losses. Diversification helps to spread the risk among different investments, such as stocks, bonds, crowdinvesting and real estate, which can provide a more stable return over time. By diversifying their investments, investors can reduce the risk of losing money due to the poor performance of one particular investment, while also increasing the likelihood of earning higher returns from others.

4. Neglecting portfolio monitoring and rebalancing

It's important to keep an eye on the portfolio and make necessary adjustments periodically to maintain the desired asset allocation and risk level. Without monitoring and rebalancing, an investor's portfolio can become too heavily weighted in one asset class, leading to undue risk exposure. This can result in missed opportunities to capture gains in other areas and potential losses in over-weighted areas. By establishing a routine of regular portfolio monitoring and rebalancing, investors can ensure their portfolios remain aligned with their investment goals and risk tolerance.

Final thoughts on structured investment process

In summary, the investment process involves a structured and systematic approach to investing. The process includes five steps, including establishing investment objectives, determining risk tolerance, asset allocation, security selection, and portfolio monitoring and rebalancing. Following a well-defined investment process can lead to better investment decision making, improved risk management, and more consistent performance over time.

Also, it‘s crucial to avoid common mistakes such as failing to define investment objectives clearly, not considering risk tolerance, not diversifying investments, and neglecting portfolio monitoring and rebalancing. By following the investment process and avoiding common mistakes, investors can increase their chances of achieving their investment goals.

Investing can be a complex and intimidating process, but following a structured investment process can help investors achieve their long-term financial goals. By following a systematic investment process and avoiding mistakes, you can increase your chances of long-term investment success and achieve financial security. Don't be afraid to seek the help of a financial advisor or investment professional to guide you through this process, give you good investment advice and help you make informed investment decisions. With a clear investment plan and the right approach, you can achieve your financial goals and secure your future.